Advertisement|Remove ads.

Bata India Surges On GST Slab Revision, SEBI Analyst Eyes Potential Rally To ₹1,500

Bata India shares surged 6% on Thursday following the Goods & Services Tax (GST) rate revision booster. On September 3, the GST Council revised the indirect tax rates to a two-slab structure of 5% and 18%.

Footwear stocks were among the beneficiaries as GST on sub-₹2,500 products was slashed to 5%, while above ₹2,500 shall be taxed at 18%. Analysts expect footwear stocks to capture greater market share amid rising affordability.

The revised GST rates will take effect from September 22, marking the first day of the Navratri festival.

Bata India is the largest retailer and manufacturer of footwear in India, with a broad network of retail and wholesale operations, owning multiple renowned brands and modern production units.

Technical Outlook

SEBI-registered analyst Sameer Pande noted that on the monthly charts, Bata India stock took support around the ₹1,150-₹1,080 demand zone. Its Relative Strength Index (RSI) has also reversed from 32 to 42 levels, indicating a positive reversal from lower levels.

On the weekly timeframe, it has exhibited strong positive momentum, although significant resistance can be observed around the ₹1,280-₹1,310 levels. If the stock moves above ₹1,310, it could pave the way for the ₹1,500 levels. Support has been identified at ₹1,180-₹1,160 and ₹1,120-₹1,090 levels.

What Is The Retail Mood?

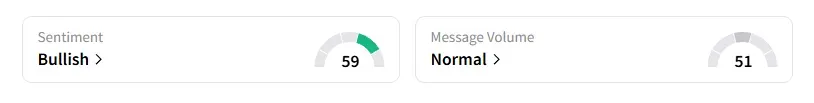

Data on Stocktwits shows that retail sentiment turned ‘bullish’ on this counter a day ago.

Bata India shares have declined 10% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)