Advertisement|Remove ads.

Bath & Body Works Stock Dives On Disappointing Earnings Guidance, China Tariff Warning — But Retail Stays Upbeat

Shares of Bath & Body Works Inc. (BBWI) dropped more than 12% on Thursday after the personal care company gave disappointing first-quarter earnings guidance, stating a potential impact from China tariffs, despite a fourth-quarter earnings beat, but retail investors remained upbeat.

Its first-quarter 2025 earnings per diluted share is expected to be between $0.36 and $0.43, compared to the consensus estimate of $0.44. Net sales are projected to grow between 1% and 3% compared to $1.38 billion in the first quarter of 2024.

For Q4, its earnings per share came in at $2.09, beating estimates of $2.04. The company reported net sales of $2.79 billion, down 4.3% from the same period last year, beating estimates of $2.78 billion. Its Q4 net sales performance was driven by strong traffic and conversion, the company said.

“Our team delivered strong performance that exceeded expectations on both the top and bottom line in the critical fourth quarter,” Gina Boswell, said CEO of Bath & Body Works. “This success was driven by our product innovation, strong execution and the outstanding customer experience provided by our associates.”

Boswell added that the company’s strategy is working, and despite “complex challenges facing the broader retail sector”, the company ended the second half of the year strong.

For fiscal 2025, the company is forecasting net sales to grow between 1% to 3%. That would be “largely below” analyst expectations of 2.8% rise, Reuters reported.

Full-year 2025 earnings per diluted share is expected to be between $3.25 and $3.60, compared to $3.61 and adjusted earnings per diluted share of $3.29 in fiscal 2024. That compares to the consensus estimate of $3.26.

“Our forward-looking guidance reflects the impact of recently enacted tariffs on goods imported from China and excludes potential impacts from other possible tariff changes," the company said in a statement.

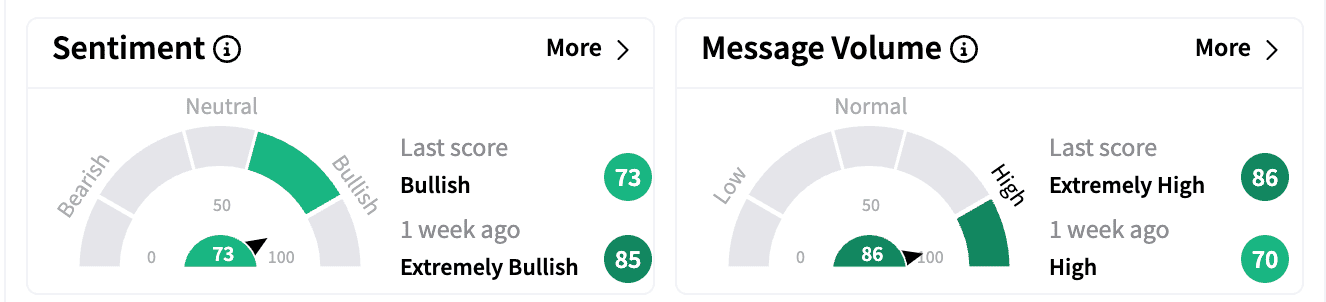

Sentiment on Stocktwits was bullish’ compared to ‘extremely bullish’ a week ago. Message volume was in the ‘extremely high’ zone compared to ‘high.’

One bullish commenter thought the company is “playing it safe” by warning against tariffs.

Bath & Body Works also approved a new share repurchase program authorizing the company to repurchase up to $500 million of its common stock, which replaced the $120 million remaining authority under the January 2024 program, according to its statement.

Bath & Body Works stock is down 7.51% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)