Advertisement|Remove ads.

Beacon Roofing's Stock In Focus As QXO's Buyout Offer Gets Regulatory Nod: Retail Sentiment Brightens

Shares of Beacon Roofing Supply ($BECN) were in the spotlight on Wednesday after technology solutions company QXO Inc. said it had obtained antitrust clearance for its $11 billion takeover of the former, lifting retail sentiment.

QXO said it had received clearance in both the U.S. and Canada that would pave the way for the transaction to close quickly. It also plans to nominate independent directors at the company’s forthcoming annual investor meeting.

“With committed financing in place and these necessary regulatory approvals secured, QXO is prepared to complete this acquisition and deliver immediate, compelling value to Beacon shareholders,” said Brad Jacobs, chairman and CEO of QXO. "Beacon should remove its shareholder-unfriendly poison pill so shareholders can benefit from our premium all-cash offer."

In a statement, Beacon said its board’s makeup already consists of “highly qualified directors” and that QXO’s director nominations “appear to be an attempt to pressure Beacon’s board into accepting an unchanged offer price that significantly undervalues Beacon’s prospects for growth and value creation”

It reiterated it is open to considering all opportunities to maximize shareholder value.

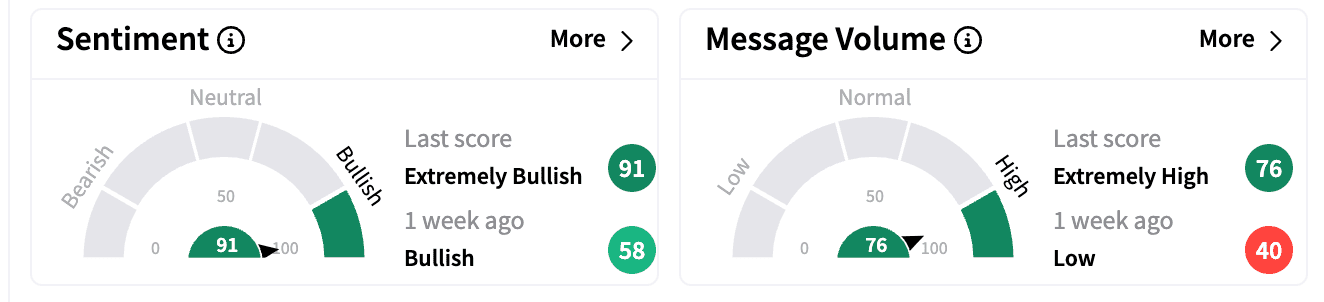

Sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a week ago with some users expressing concern if the offer would get rescinded after multiple rejections by Beacon. While message volumes jumped into the ‘extremely high’ zone from ‘low.’

Recently, Stifel downgraded Beacon to ‘Hold’ from ‘Buy’ with a price target of $122.55, down from $131 after its board rejected the $124.25 per share tender offer, Fly.com reported. According to the analyst firm, its scenario analysis favors QXO successfully acquiring Beacon at $124.25 per share.

In January, QXO commenced a tender offer to purchase all outstanding shares of Beacon for $124.25 per share in cash for an aggregate enterprise value of approximately $11 billion, representing a 37% premium to Beacon's 90-day unaffected volume-weighted average price per share as of November 15, 2024.

Beacon distributes specialty building products, including roofing materials and complementary products, such as siding and waterproofing. It operates over 580 branches throughout all 50 states in the U.S. and seven provinces in Canada.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219715394_jpg_c787a7b591.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_martin_shkreli_jpg_4da92d4843.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)