Advertisement|Remove ads.

Best Buy Stock Sinks To 5-Year Low As Analysts Flag Worst Blow From Tariffs: Retail Stays Bearish

Shares of Best Buy Co, Inc. (BBY) fell 8.3% to their lowest since the onset of the COVID-19 pandemic on Tuesday after at least two analysts lowered their price targets over a potential hit to the company's business from the new U.S. import tariffs.

The stock closed at $56.17, the lowest since April 2020.

Truist cut its price target to $64 from $81, while maintaining a 'Hold' rating, and Evercore ISI slashed the target by $10 to $70, while also maintaining an in-line rating, according to The Fly and MT Newswires.

Truist analysts said Best Buy, Five Below (FIVE), and Target Corp (TGT) are the most at risk from tariffs due to the discretionary nature of their products.

They added that falling consumer confidence might further affect sales, although a wider mix of groceries and value products might partially offset the pressures.

Best Buy's retail stores specialize in selling consumer electronics and appliances, which typically see weak sales during periods of high inflation and macroeconomic uncertainty.

Evercore's price action comes a month after the research firm added Best Buy to its 'Tactical Underperform' list, a selection of stocks it thinks will underperform the market in the near term.

Last week, Citi cut its rating on Best Buy, echoing the sentiment that the company could be one of the worst affected by the tariffs.

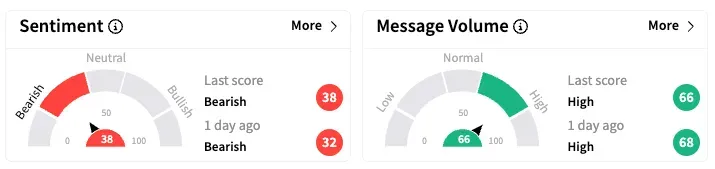

On Stocktwits, retail sentiment for the stock remained 'bearish', while message volume was high.

One user expressed frustration over CEO Corie Barry's management decisions, including abandoning the store experience.

Currently, 18 of 30 analysts rate the stock 'Hold' and 11 rate it 'Buy' or higher, according to Koyfin data. Their average target price is $88.89.

BBY shares are down 34.5% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)