Advertisement|Remove ads.

Bausch Health Stock Pops After-Hours On Q4 Earnings Beat, Bullish Outlook: Retail Confidence Rises

Bausch Health Companies Inc. shares (BHC) jumped over 7% in after-hours trading on Wednesday following a solid fourth-quarter earnings report that beat revenue estimates and reaffirmed strong guidance for 2025.

The company posted Q4 revenue of $2.56 billion, surpassing the consensus estimate of $2.51 billion, while adjusted earnings per share (EPS) of $1.14 narrowly topped expectations of $1.13.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) came in at $935 million, up from $869 million a year ago.

CEO Thomas Appio highlighted 2024 as a year of "delivering on our commitments," with results landing at the high end of revenue guidance and exceeding expectations for adjusted EBITDA (excluding Bausch + Lomb) and operating cash flow.

Salix, the company's gastrointestinal and hepatology division, generated $634 million in Q4 revenue, up 9% year-over-year. This was largely driven by Xifaxan, a treatment for irritable bowel syndrome and traveler's diarrhea, which posted 16% growth.

The Solta segment, which includes medical aesthetics, saw Q4 revenue climb 34% to $138 million, fueled by strong demand in South Korea and China.

For 2025, Bausch Health projects revenue between $9.90 billion and $10.15 billion, above the consensus estimate of $9.89 billion.

The company also forecasts FY25 adjusted EBITDA between $3.525 billion and $3.675 billion.

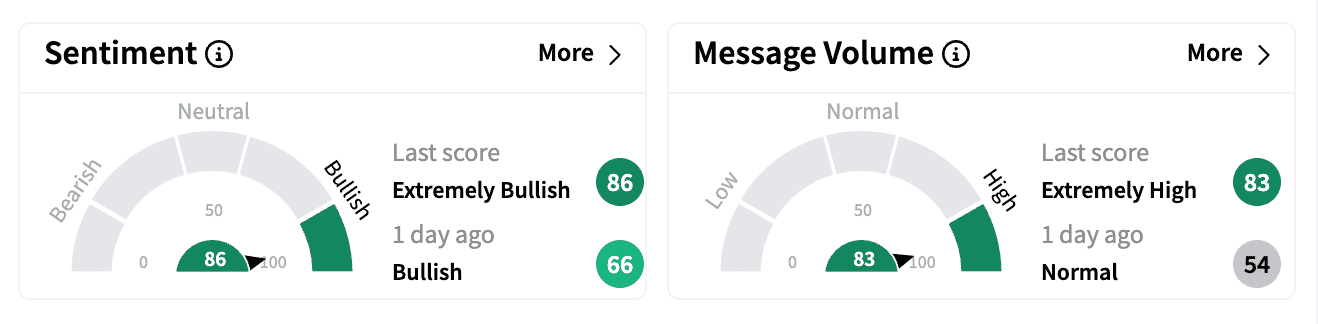

Retail sentiment on Stocktwits turned 'extremely bullish' following the earnings report, with message volume spiking 1,900% on Wednesday.

One user highlighted "very good organic revenue growth and solid guidance," expecting a strong bounce for the stock.

Another hoped for a rally past $20 per share.

However, BHC shares remain about 35% below analysts' average target price of $8.83.

The stock has lost over 19% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)