Advertisement|Remove ads.

BigBear.ai ($BBAI) Rally In Doubt As Retail Sentiment Peaks

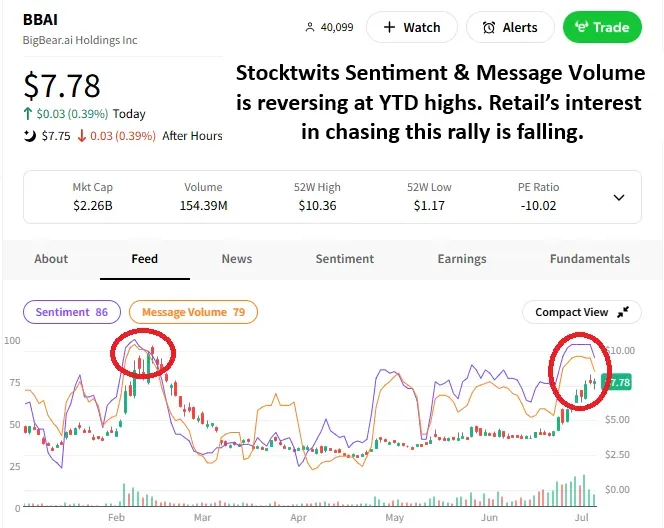

Small-cap AI company BigBear.ai Holdings is up roughly 260% from its April lows and is trending alongside some of the artificial intelligence (AI) space’s most popular names. However, Stocktwits Sentiment and Message Volume may be suggesting that this rally has run its course. Let’s take a look.

As we can see, Stocktwits Sentiment and Message Volume both approached their year-to-date highs last week as prices rallied; however, both have begun to fall over the last few days, despite prices remaining stable. This could be an indicator that retail investors and traders are becoming slightly less bullish and that finding the “next marginal buyer” at these levels is becoming more difficult.

Traditional momentum indicators, such as the Relative Strength Index (RSI), are also flashing an interesting signal. Over the last two years, large spikes above 70 into “overbought” territory coincided with the start of price corrections. Not all of them did, but these are levels that raise a caution flag and are worth monitoring.

While there’s clearly significant social and price momentum behind this name over the long term, these signals suggest retail’s enthusiasm may be cooling slightly as they wait for more attractive prices to enter on the long side. Time will tell.

Add $BBAI to your watchlist to monitor this move. More importantly, to source these sentiment insights yourself, subscribe to Stocktwits Edge to unlock all the historical sentiment data for equities and crypto.

Unlock Stocktwits Sentiment insights with Stocktwits Edge — subscribe now.

*This real-time Stocktwits Sentiment use-case example was curated by Stocktwits’ Editor-in-Chief, Tom Bruni, and is solely for informational and educational purposes. Tom does not hold any positions in BigBearAI as of the time of publishing. For any questions or comments, please email tbruni[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)