Advertisement|Remove ads.

Inozyme Stock Rockets 179% After BioMarin Agrees To Acquire The Company For $270M: Retail Sentiment Brightens

Shares of Inozyme Pharma, Inc. (INZY) rocketed 179% on Friday after BioMarin Pharmaceutical (BMRN) agreed to acquire the company for $270 million.

Under the deal, BioMarin will acquire Inozyme for $4 per share in an all-cash transaction. The deal's per-share price consideration implies an 182% premium to Inozyme’s closing price of $1.42 on Thursday.

BioMarin will commence a cash tender to acquire all of Inozyme's outstanding shares. A majority of the outstanding shares must be tendered for its consummation.

Inozyme's Board of Directors unanimously recommended that shareholders tender their shares in the offer.

Following the successful completion of the tender offer, a wholly-owned subsidiary of BioMarin will merge with Inozyme. The transaction is expected to close in the third quarter of 2025.

BioMarin said that it expects the acquisition to strengthen its enzyme therapies portfolio.

Inozyme’s late-stage enzyme replacement therapy, INZ-701, is currently being assessed for the treatment of Ectonucleotide Pyrophosphatase/Phosphodiesterase 1 deficiency (ENPP1), a rare genetic disorder caused by mutations in the ENPP1 gene, leading to loss of ENPP1 enzymatic activity. Currently, there are no approved therapies for ENPP1 Deficiency, Inozyme said.

BioMarin CEO Alexander Hardy said that the company will continue to evaluate both external and internal innovation going forward.

“We are in a strong financial position to bring in additional assets as we accelerate the development of medicines for patients with significant unmet need," he said.

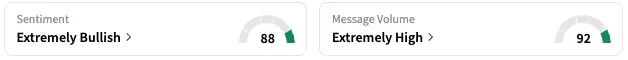

On Stocktwits, retail sentiment around Inozyme jumped from ‘neutral’ to ‘extremely bullish’ territory over the past 24 hours while message volume jumped from ‘high’ to ‘extremely high’ levels.

For BioMarin, retail sentiment around the company fell from ‘bullish’ to ‘neutral’ territory over the past 24 hours.

INZY stock has gained by 39% this year but has fallen by nearly 16% over the past 12 months.

BMRN stock is trading nearly 2% higher as of Friday noon.

Also See: Volkswagen Shareholders Flag Governance Issues At Carmaker, Says Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)