Advertisement|Remove ads.

Birkenstock Stock In Focus After Q1 Earnings Beat: Retail Mood Improves

Birkenstock (BIRK) shares slipped 4.6% in after-hours trading on Thursday even as the footwear maker posted better-than-expected fiscal first-quarter earnings, lifting retail sentiment.

Earnings per share came in at EUR 0.18 ($0.19), beating consensus expectations of $0.17. It posted revenue of EUR 362 million ($379.71 million), up 19%, beating estimates of $372.33 million, according to Stocktwits data.

The company’s top-line growth was thanks to strong consumer demand over the holiday season. Specifically, its close-toe silhouettes grew at more than twice the pace of the group average and increased share of business by 600 basis points, according to a company statement.

Birkenstock saw “strong double-digit revenue growth across all segments” including 16% in the Americas, 17% in EMEA and 47% in APAC.

“Our clogs, other closed-toe shoes and boots performed very well, with share of business up 600 bps year-over-year. We once again saw very strong growth across all of our segments, with APAC coming in exceptionally strong as we accelerated the pace of store openings and deliveries to some B2B partners in the quarter,” said Oliver Reichert, CEO of Birkenstock. “With the strong start to the year, we are confident in our ability to deliver on our guidance for 2025.”

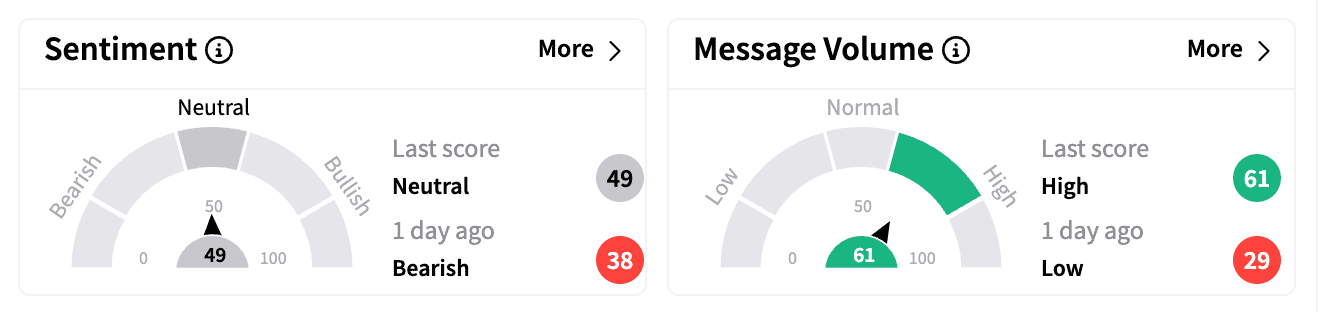

Retail sentiment on Stocktwits improved to ‘neutral’ from ‘bearish’ a day ago. Message volume climbed to ‘high’ from ‘low.’

For 2025, Birkenstock confirmed revenue growth outlook between 15%-17% in constant currency terms.

Piper Sandler recently assumed coverage of Birkenstock with an ‘Overweight’ rating and $65 price target.

Birkenstock stock is down 4.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

(Conversion: EUR 1 = $1.04)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)