Advertisement|Remove ads.

BIT Mining Expands Ethiopian Crypto Footprint With Data Center Buyout: Retail Stays Optimistic

BIT Mining (BTCM), a company focused on cryptocurrency infrastructure and technology, on Monday finalized the second stage of its acquisition of Bitcoin mining operations in Ethiopia.

Following the announcement, BIT Mining stock gained over 24% after Monday's opening bell.

In December 2024, the company signed a definitive deal to purchase a portfolio of cryptocurrency mining data centers in Ethiopia.

It finalized the first phase of that transaction on Dec. 9, 2024. The second phase, now complete, includes both infrastructure and deployment of mining hardware, positioning the firm to boost its processing power substantially in the region.

The company said that it had issued over 45 million Class A ordinary shares to secure the remaining data center assets and Bitcoin mining equipment under its December 2024 purchase agreement.

These developments bring the total power capacity of its Ethiopian mining infrastructure to 51 megawatts.

On July 10, BIT Mining made a major move to expand beyond Bitcoin-centric operations and into a broader spectrum of blockchain technologies through a $300 million Solana (SOL) treasury plan.

The company put forth its plans to raise between $200 million and $300 million in funding, which will be used to purchase SOL tokens.

"While we continue to make progress in our crypto mining operations, we have strategically shifted our focus to actively explore opportunities within the Solana ecosystem," said Xianfeng Yang, CEO of BIT Mining.

BIT Mining is creating a unified ecosystem for digital currency mining, which includes operating its own mining facilities, offering infrastructure support services, and producing proprietary mining hardware.

The latest move comes as global miners continue to diversify operations geographically, often in search of stable electricity and supportive policy environments.

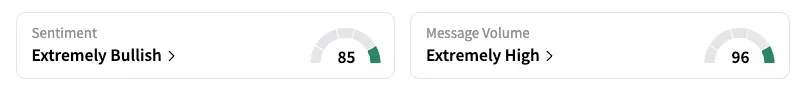

On Stocktwits, retail sentiment toward BIT Mining remained in ‘extremely bullish’ territory (85/100) amid ‘extremely high’ (96/100) message volume level.

BIT Mining stock has added over 57% year-to-date and over 17% in the last 12 months.

Also See: Synopsys-Ansys’ $35B Deal Reportedly Gets China’s Conditional Approval Days Before Closure Deadline

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)