Advertisement|Remove ads.

Black Rifle Coffee Stock In Focus Ahead Of Q4 Earnings: Retail's Downbeat

Shares of Black Rifle Coffee dipped more than 2% in the past five trading days ahead of the company’s fourth-quarter earnings, dampening retail sentiment.

Wall Street analysts expect the company to post a loss per share of $0.01 on estimated revenue of $106.2 million. The company has beaten EPS estimates thrice in the past four quarters and revenue estimates twice.

Black Rifle Coffee is scheduled to report earnings after the market closes on Monday.

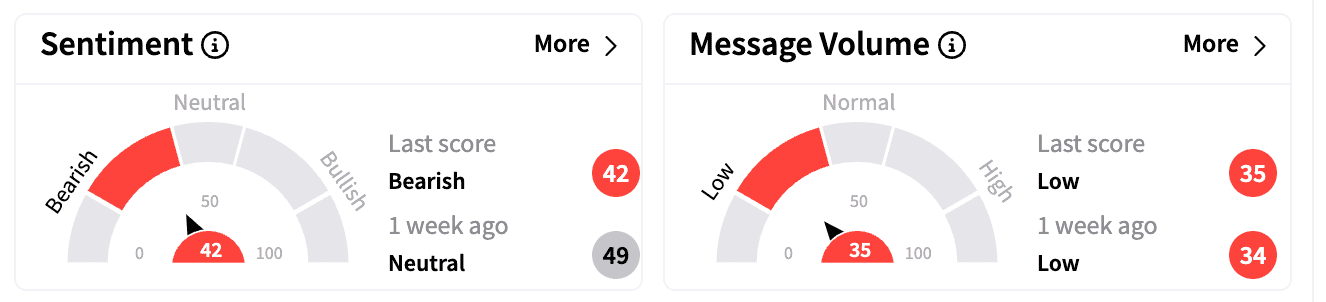

Sentiment on Stocktwits turned 'bearish' compared to ‘neutral’ a week ago. Message volumes remained in the ‘low’ zone.

However, one bullish commenter praised the company’s products and suggested the company should have a higher market cap.

In January, the company reaffirmed its 2024 guidance, saying it expects net revenue between

$390 million and $395 million, with a gross margin rate between 40% and 42%.

Adjusted earnings before interest, depreciation, and amortization (EBITDA) is expected in the range of $35 million and $40 million, the company added.

For Q3, the company posted a loss per share of $0.01, better than the expected $0.02. Revenue stood at $98.2 million, beating analyst estimates of $95.3 million, according to Stocktwits data.

“Our third-quarter performance showcases our continued focus on improving operational excellence,” said BRCC CFO Steve Kadenacy, noting the company’s wholesale business continues to gain momentum, laying the foundation for growth across multiple product categories and channels over the coming years.

“We remain on track to have our coffee products in most major grocery chains by the end of 2025, and we are confident that the rollout of our energy drink will open new market opportunities and further accelerate our growth,” Kadenacy said.

Black Rifle Coffee stock is down 18.61% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)