Advertisement|Remove ads.

Black Rifle Coffee Stock Slips After-Market On Q4 Revenue Decline: Retail’s Downbeat

Shares of Black Rifle Coffee (BRCC) dropped nearly 4.5% in after hours trading on Monday after the company’s fourth-quarter revenue fell short of estimates, dampening retail sentiment.

For Q4 its loss per share stood at $0.03, better than a feared loss of $0.05, according to The Fly. Revenue decreased 11.5% to $105.9 million, missing Wall Street estimates of $106.2 million.

Its Q4 net loss narrowed to $6.7 million from net loss of $14 million in the same period last year.

Wholesale revenue decreased 8.6% to $67.2 million, driven by a $12.7 million net reduction in barter transaction revenue offset by continued distribution gains and sales growth in the FDM market, growth in our ready-to-drink (RTD) coffee product, and revenue from initial shipments of Black Rifle Energy, the company said.

BRC sees FY25 revenue between $395 million and $425 million, compared to the consensus estimate of $414.85 million. It expects adjusted earnings before interest, depreciation, and amortization (EBITDA) to be between $20 million and $30 million.

"Black Rifle made significant progress in strengthening our operations, bolstering our market presence, and improving profitability over the past year," said BRC’s CEO Chris Mondzelewski.

"With expanded coffee distribution, the launch of Black Rifle Energy, and our strategic partnerships with Keurig Dr Pepper (KDP), we have built a strong foundation for long-term growth. While there is still work to be done in 2025, I am confident in our ability to execute on our strategy and build momentum.”

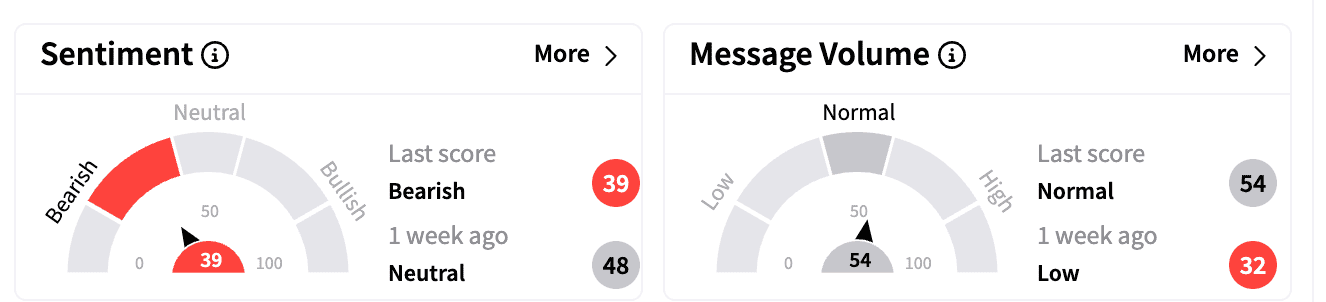

Sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a week ago. Message volume climbed to ‘normal’ from ‘low.’

One bullish commenter noted the company’s strategy of completely shifting their business focus to wholesale, and going from direct-to-consumer (DTC), and with its new product launch, the company’s Q3 “will be the one to watch.”

Black Rifle Coffee stock is down 18.9% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)