Advertisement|Remove ads.

American Airlines Stock Slides As Winter Storm Chaos Cancels Over 1,500 Flights During Holiday Rush

- Flight disruptions mounted nationwide, with thousands of delays and cancellations reported by midday.

- Airlines waived change fees at major hubs as storm warnings spread across key travel regions.

- Analysts maintained longer-term optimism for major carriers despite near-term weather disruptions.

Shares of American Airlines (AAL) fell nearly 2% on Friday as a powerful winter storm disrupted holiday travel across large parts of the U.S., grounding flights and straining airline operations during one of the busiest travel periods of the year.

Flight-tracking site FlightAware showed widespread disruption by midday, with 1,540 flights canceled and 3,974 delayed nationwide.

Storm Warnings Snarl Major Airports

The National Weather Service forecast hazardous winter weather conditions would extend from the Great Lakes to the northern Mid-Atlantic and into southern New England into Saturday morning.

Airport authorities in the path of the storm, such as those for John F. Kennedy International Airport and Detroit Metropolitan Wayne County Airport, informed travelers on X of delays and potential cancellations as the weather conditions worsened.

Airlines Cancel Flights, Waive Change Fees

FlightAware reported several carriers have had to cancel out hundreds of flights, led by JetBlue Airways, which has grounded 225, followed by Delta Air Lines at 177 and Republic Airways at 153.

American Airlines and other large carriers such as United Airlines, Southwest Airlines, Delta and JetBlue have waived change fees for customers who travel through the affected airports such as Philadelphia International Airport, JFK and Newark Liberty International Airport. Airlines have said any rebooked travel must be completed by the end of the year.

Disruptions Come During Record Holiday Demand

The timing of the storm has added to the strain. Travel group Airlines for America is predicting that the nation's carriers will transport a record 52.6 million passengers from Dec. 19 through Jan. 5, with Friday and Sunday among the peak travel days of the holiday season, according to a CNBC report.

Passenger aircraft are already flying close to full so airlines are telling people to book flights as early as possible, because there are not many seats available on Christmas week flights.

American Airlines Revamps DFW Operations

American Airlines is making operational changes at Dallas Fort Worth International Airport (DFW), its largest hub, as it attempts to better navigate disruptions and regain operational reliability. Effective in April (as per the carrier’s schedules starting Dec. 27), AA will expand its DFW operation from nine to 13 banks of flights as part of an effort to decongest its operations at DFW and improve connecting travel.

The carrier has also increased block time on flights in a bid to boost on-time performance and has made "millions of dollars" in investments in airport infrastructure, traffic-flow improvements and remote deplaning resources that the carrier says will enable it to recover more quickly when severe weather hits.

Analysts Still Favor Major Airlines Longer Term

While weather-related disruptions weighed on airline stocks in the near term, American Airlines entered the holiday season with relatively supportive analyst views. Earlier this month, Citi initiated coverage on several major U.S. carriers, including American, with a ‘buy’ rating, citing expectations for a stronger demand cycle beginning in 2026.

Citi said the industry’s largest airlines are better positioned than low-cost carriers, which continue to struggle with rising costs and softer demand for economy fares.

How Did Stocktwits Users React?

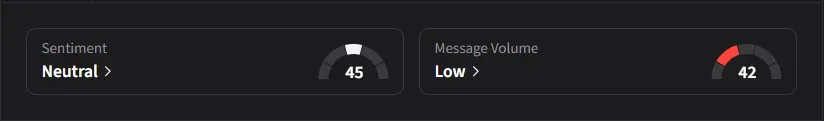

On Stocktwits, retail sentiment for American Airlines was ‘neutral’ amid ‘low’ message volume.

American Airlines’ stock has declined 12% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lithium_47e0215e10.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_evolent_jpg_3c3f2aa8e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250655281_jpg_c8c0e9352f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)