Advertisement|Remove ads.

Bausch + Lomb Stock Surges On Report Of Potential Sale: Retail Cheers Even As Analysts Assess Impact

Shares of Bausch + Lomb Corp. (BLCO) soared 13% on Monday following reports that the eye care giant is considering selling itself to alleviate the financial strain of its heavily indebted parent company, Bausch Health Companies (BHC).

The Financial Times reported that private equity firms are likely among the potential buyers, with Bausch + Lomb reportedly working with Goldman Sachs to explore interest.

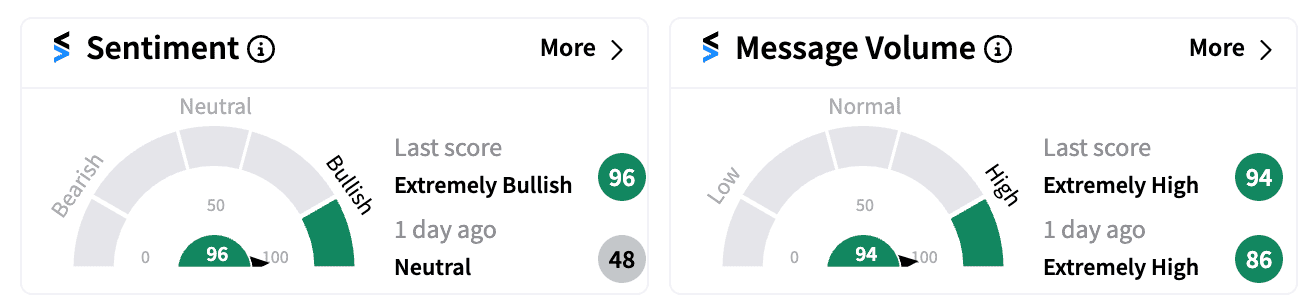

The news has sent retail sentiment into overdrive, with watchers on Stocktwits turning ‘extremely bullish’ (96/100) on the stock, hitting its second-highest score this year.

The proposed sale is seen as a positive move that could potentially distance Bausch + Lomb from the $21 billion debt burden currently weighing down Bausch Health, which spun off the eye care division in 2020.

Of the debt, nearly $10 billion is reportedly set to mature by 2027.

Analysts have offered mixed reactions to the report.

JPMorgan’s Robbie Marcus maintained a ‘Neutral’ rating on BLCO shares, noting that while the company is well-known globally, over 70% of its earnings come from its Consumer and Prescription Ophthalmic Drug segments, making it more of a drug company.

Marcus pointed out that this could deter private equity buyers looking for a cash-flow-heavy asset to flip for profit.

However, Wells Fargo is more optimistic, maintaining an ‘Overweight’ rating on Bausch + Lomb and setting a price target of $23. The brokerage believes that the significant valuation discount between BLCO and other eye care peers like Cooper (COO) and Alcon (ALC) makes a sale both logical and attractive.

BLCO shares currently trade at a lower multiple compared to these companies, but Wells argues that a deal could close that gap.

On Stocktwits, one retail investor cheered the potential deal, saying, “$BHC this $BLCO outright sale might just get this moving towards $7.5.”

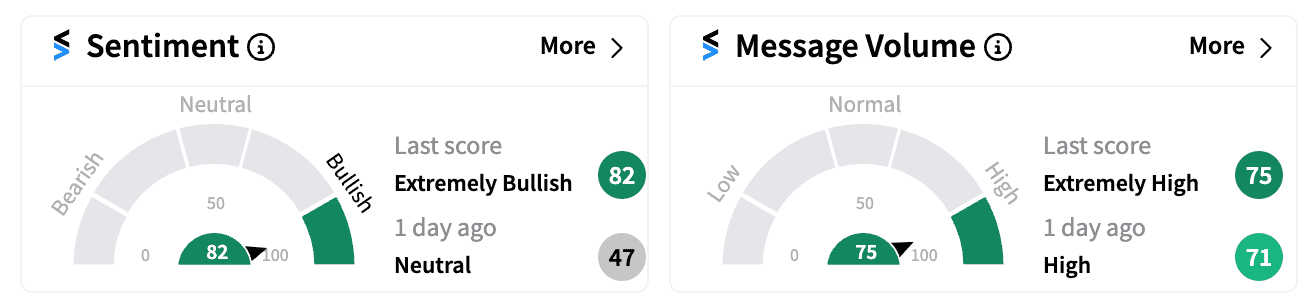

Shares of Bausch Health also saw gains, climbing over 4% as retail sentiment turned ‘extremely bullish’ (82/100).

While BHC shares remain down more than 15% year-to-date, BLCO has managed to outperform, up over 4% so far this year.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)