Advertisement|Remove ads.

Is This Penny Stock A Trump Movie Tariff 'Sympathy Play'? Retail Speculation Heats Up For BloomZ Amid After-Hours Surge

BloomZ, Inc. (BLMZ), a penny stock, defied the broader market downturn on Monday and advanced over 8%. The upward momentum accelerated further after-hours as it jumped over 84%.

The strong gains came despite a lack of any meaningful catalysts.

Retail chatter about BloomZ stock grew louder amid the stock surge. By late Monday, the 24-hour change in the message volume was a whopping 6,650%. The follower count increased by over 13% over the same timeframe.

Founded in 2017, BloomZ is an audio-producing and voice actor-managing company based in Tokyo, Japan.

The company went public in July 2024 by offering 1.25 million shares priced at $4.30 apiece, raising $5.38 million.

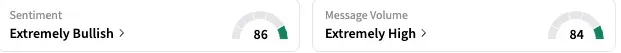

By late Monday, retail sentiment toward BloomZ stock was 'extremely bullish' (86/100), and message volume was at 'extremely high' levels.

A bullish user said the move in BloomZ stock was not "precisely random." They saw it as a "sympathy play" amid the threat of 100% tariffs on movies made overseas.

Another watcher said BloomZ is among the top stocks to watch on Tuesday. "Looking good on [a] 4 hours chart," they said, adding that the 0.2-0.23 level will likely act as key support and $0.88-$0.92 as key resistance.

A third user predicted a short-squeeze, taking the stock to over $1 in Tuesday's premarket trading. However, short interest on the stock is merely 0.80% with 13.43 million in outstanding shares, according to Koyfin.

BloomZ stock has lost about 45% so far this year and has been down over 92% since its listing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210921290_jpg_46bb1e6211.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)