Advertisement|Remove ads.

Budweiser Maker’s Stock Gets Crushed After Q2 Gloom — Retail Traders Feel 'Drop Is A Bit Unjustified'

Retail sentiment around Anheuser-Busch InBev (ABI), the maker of Budweiser and Corona beers, ticked higher, even as a weak quarterly report sent its shares sliding on Thursday.

BUD's U.S.-listed shares dropped over 13% in the previous session, marking their worst day in over five years.

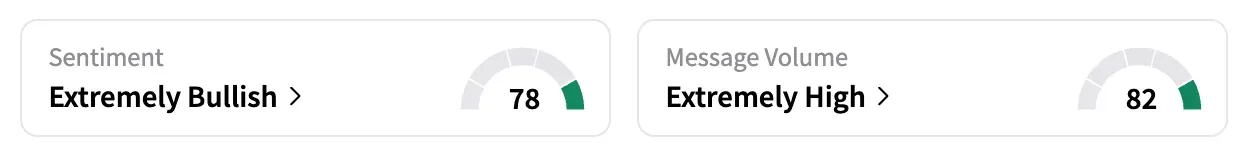

On Stocktwits, retail sentiment shifted to 'extremely bullish' by early Friday, up from 'bullish' the day before, as traders viewed the slide as an overreaction and saw it as a buying opportunity. Message volume for BUD rose 1,200% in the past 24-hour period, among the highest for a consumer stock.

"Not a fan of the company, but this drop is a bit unjustified," said one user

Another said: "$BUD Buying dat dip, 10% discount? Thank you!" A third user shared a technical chart showing the stock hitting a key long-term support level.

AB InBev said revenue grew 3% organically in the second quarter, below market expectations of 3.2% growth. Organic sales volumes, however, were down 1.9%, primarily due to weak sales in Brazil and China, marking the ninth consecutive quarter of declining beer sales. That was significantly below the 0.3% decline analysts had expected.

Organic operating profit increased by 6.5%, ahead of analysts' forecasts of 5.7%.

The world's largest brewer also reported weaker-than-expected volumes in Europe and the Middle East, which led to disappointment in all regions except North America.

A rebound in the home market comes even as beer demand softens in the region. Bank of America has predicted that U.S. beer volumes will shrink by 4% next year, steeper than its earlier prediction of 1% decline.

In early July, AB InBev announced plans to invest $300 million in its U.S. manufacturing operations this year, aligning with the Trump administration's broader push for domestic production.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Starbucks China Operations: JD, Tencent, KKR Among Potential Investors To Submit Bids - Report

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)