Advertisement|Remove ads.

‘Buy The Freaking Dip!’ Retail Traders Rally Behind Amazon As Stock Tanks Despite Crushing Q2 Estimates

Retail investors believe they have found the choosiest of opportunities to load up on Amazon.com (AMZN) shares, after the stock dipped on concerns around its cloud unit growth, despite an otherwise strong quarterly report on Thursday.

Amazon surpassed expectations for second-quarter revenue and profit, as well as its business forecast for the ongoing quarter, signaling that its mainstay online retail business has remained steady despite tariff pressure.

However, a nearly 18% growth in Amazon Web Services sales in Q2, while above expectations, looked pale in comparison to the much higher rates posted by rivals recently.

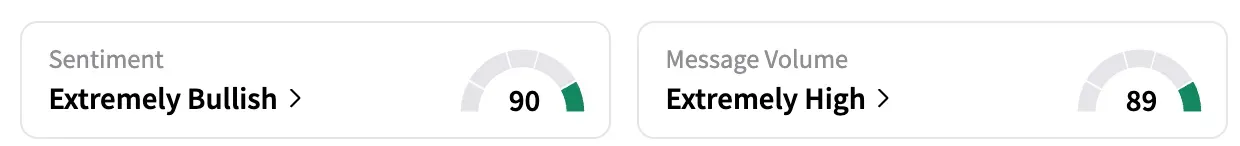

On Stocktwits, retail sentiment for AMZN shares shifted to 'extremely bullish' (90/100) as of late Thursday, from 'bullish' the day before, even as the stock dropped 6.6% in extended trading. Message volume rose over 600% in the past 24-hour period, and AMZN was the top trending ticker on the platform at the time of writing.

"Irrational selling," a user remarked, while another said, "Buy the freaking dip!"

AWS reported a 17.5% increase in revenue to $30.9 billion, edging past expectations of $30.77 billion. Microsoft's (MSFT) Azure posted a 39% rise in sales for the June quarter, while Google Cloud revenue rose by 32%.

Amazon CEO Andy Jassy assured analysts on the post-earnings call, stating that AWS has a "pretty significant market segment leadership position" and technical advantages, including better security.

"We have a meaningfully larger business in the AWS segment than others," Jassy said. "I think the second player is about 65% of the size of AWS."

He noted that adding capacity has been a constraint; however, going forward, efforts to lower the costs of running AI applications will draw more customers over time.

Gene Munster, managing partner at Deepwater Asset Management, said investors are concerned about the margin contraction in AWS. They declined to 32.9% in the second quarter, from 39.5% in Q1 2025 and 35.5% in Q2 2024.

On the retail front, the impact of Trump tariffs on internal costs and consumer demand seemed limited, the company indicated.

"Through the first half of the year, we haven't yet seen diminishing demand nor prices meaningfully appreciating," Jassy told analysts.

He added, "We just don't know what's going to happen moving forward. It's hard to know where the tariffs are going to settle, particularly in China."

Amazon reported that online store sales increased 11% to $61.5 billion. Advertising sales, a fast-growing segment for Amazon, were up 23% to $15.7 billion.

Overall revenue rose over 13% to $167.7 billion, beating analysts' estimate of $162.19 billion.

Amazon expects total net sales to be between $174.0 billion and $179.5 billion in the third quarter. Analysts had expected $173.08 billion, according to data compiled by LSEG.

Amazon shares are up 6.7% year-to-date, compared to the 7.9% rise in SPDR S&P 500 ETF (SPY), which tracks S&P 500 stocks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229385023_jpg_648b095662.webp)