Advertisement|Remove ads.

Beyond Meat's Wild Week Cools Off; Wealth Manager Warns Of 'Classic' Short Squeeze 'Done By A Gang'

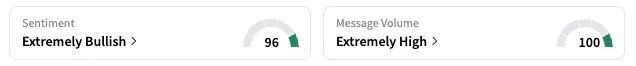

- Beyond Meat’s stock traded within a wide range on Wednesday, before declining in the after-market session.

- B. Riley’s Art Hogan advises caution, says the same "gang” pumps such meme stocks before broader market dynamics rationalize the price.

- Retail traders are still upbeat, with sentiment for the ticker on Stocktwits holding firm in the 'extremely bullish' zone.

Beyond Meat, Inc. appears to be losing the boost from the meme-driven frenzy that catapulted its price this week, and a wealth management expert feels that trading the stock at this point could be dangerous.

“It's not something I would play,” Art Hogan, chief market strategist at B. Riley Wealth Management, told Yahoo Finance in an interview late Wednesday.

BYND Rally Losing Momentum

BYND shares fell 11.2% in after-hours trading on Wednesday. During the regular session, the stock swung sharply between an intraday low of $2.62 and a high of $7.69, before closing at $3.58 — down 1.1% from the previous day.

Beyond Meat has attracted intense investor interest amid a sharp rally driven partly by its expanded partnerships but fueled largely by retail enthusiasm and a short squeeze. As of Wednesday’s close, the stock is up over 450% and is headed for its best week ever.

Analyst Urges Caution

“The only way to benefit from this, as a company, is to set up ATM [at the market], meaning sell shares into this mania. And maybe with the capital you raise, you can reinvent your business model,” said Hogan.

For investors, Hogan said the short squeeze, which is easily identifiable given the over 50% short interest in BYND stock, typically does not end well.

“It's a classic short squeeze, but it's done by a gang, right?” he said, referring to a group of power investors that typically attempt to boost stocks on social media.

“So you get the gang of investors together. They target one, two, or three stocks… They're all reading the same information, diving in at the same time.” However, he added that market dynamics ultimately prevail as the “group that is doing this is much smaller than the broader market.”

What Do Retail Investors Think?

That said, retail investors seemed to be throwing caution to the wind. The sentiment on Stocktwits was ‘extremely bullish’ (96/100) as of early Thursday, although it dipped a couple of points from the previous day.

Comments ranged from setting an alarm for 4 am – the premarket opening time – to watching for $10 price. “Ground floor is $3.00. We shall hold the line and push forward,” said one user, in an attempt to rally support for the stock.

Year-to-date, BYND stock is still down nearly 5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Why Las Vegas Sands Stock Jumped Nearly 4% After-Hours

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)