Advertisement|Remove ads.

BuzzFeed Stock In Focus After Company Posts Profit; Retail’s Happy

Digital media company BuzzFeed Inc. (BZFD) stock surged nearly 6% earlier in the morning session but later fell 1%, following the company’s better-than-expected third-quarter earnings and return to profitability, lifting retail sentiment.

Rye, N.Y.-based BuzzFeed swung to a profit of $2 million compared to a net loss of $12.5 million in the year-ago quarter. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) rose to $10.5 million from $0.3 million in the year-ago period.

Quarterly revenue surged 7% to $64.3 million from a year earlier, driven by strength in its affiliate commerce and programmatic advertising businesses, two of its largest and highest-margin revenue streams, which grew 53% and 9% respectively.

The company said its new focus on most scalable, tech-driven revenue lines was responsible for much of the revenue growth in its programmatic and affiliate businesses, which will be key drivers for its future profitability.

“In Q3, we delivered significant improvements in each of our key operating and financial measures — time spent, revenue and Adjusted EBITDA — growing each year-over-year and quarter-over-quarter,” Jonah Peretti, BuzzFeed Founder & CEO, said in a statement. “These strong Q3 results underscore the successful execution of our strategy to stabilize the business.”

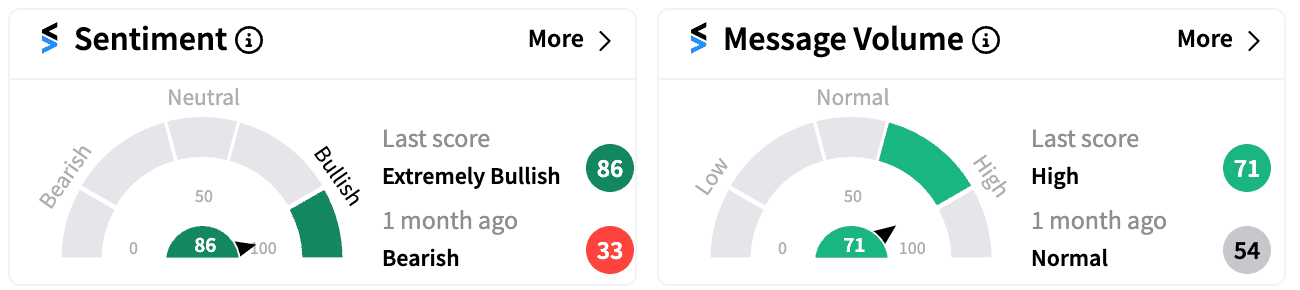

Retail sentiment on the stock has turned ‘extremely bullish’ (86/100) from ‘bearish’ (33/100) a month ago, while message volume has spiked to ‘high’ levels.

The company's return to profitability suggests a “potential shift in the company's financial trajectory,” according to analysts tracked by Investing.com

Stocktwits users were equally surprised:

BuzzFeed is the parent of BuzzFeed Studios, which produces original content across broadcast, cable, film and digital platforms, It also publishes BuzzFeed News and HuffPost.

BuzzFeed’s stock is up 176% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_unh_stock_resized_jpg_e69fd915e3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2237643016_jpg_17a9a7eb9d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347257_jpg_0d49570035.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2196133264_jpg_43c746e098.webp)