Advertisement|Remove ads.

Caesars Says Poor Uptake In Las Vegas Weighed On Q3 Results, Shares Drop

- Caesars’ Las Vegas revenue declines nearly 9%, leading to below-expectation overall sales.

- Las Vegas saw lower visitation, with CEO Tom Reeg calling the period a “soft summer.”

- The casino operator’s net loss widens multifold.

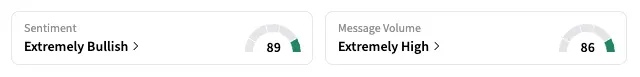

Caesars Entertainment Inc.’s shares dropped 7.4% in the after-market session on Tuesday, although the Stocktwits sentiment ticked higher, after the company reported third-quarter revenue below estimates and a wider loss owing to weak activity in Las Vegas.

Calling it a “soft summer,” CEO Tom Reeg said price-conscious consumers skipped casinos and other activities in the U.S. gambling hub, with Caesars seeing a decline in occupancy rates.

Las Vegas Losing Its Appeal?

“It was a difficult summer,” Reeg said, adding that trends were improving in the fourth quarter. “That brings us back to a much healthier looking market as we look at this quarter and into 2026.”

Caesars is the largest casino operator in the U.S., with properties in 16 states, and overseas resorts in the UK, Egypt, and South Africa.

In the third quarter, the company’s revenue was roughly flat at $2.87 billion compared to the year-ago quarter. Analysts expected $2.89 billion. Revenue for the company’s Las Vegas business decreased by 9.8%, hurt by a broader decline in visitations to the city.

Net loss in the period was $55 million, or $0.27 per share, rising multifold from $9 million, or $0.04 per share, last year. Analysts had expected a $0.02 per share loss.

What Is Retail Investors' View?

On Stocktwits, the retail sentiment for CZR to ‘extremely bullish’ as of late Tuesday, from ‘neutral’ the previous day, with 24-hour message volume rising 4,000%.

“$CZR This is way oversold,” said one user, adding that they are buying shares.

Another user was less optimistic, saying that “Vegas as we all once knew it is dying on the vine” and that younger consumers are even skipping drinking altogether.

Caesars Weighs In On Prediction Markets

Meanwhile, Caesars’ Reeg said the company was watching developments in prediction markets — a fast-emerging space led by Kalshi and Polymarket, and one that iGaming players such as DraftKings are preparing to enter.

“We believe what's happening in prediction markets is sports gambling,” he said. “If there's a path that develops where we can participate in a way that doesn't put licenses at risk… (we) would be prepared to go down that path, but we're watching it the same as you are.”

Year-to-date, the CZR stock is down 34%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)