Advertisement|Remove ads.

CAMS Shares Fall 3% After Q4 Print: Citi Maintains ‘Sell’ While SEBI RA Sees ₹3,900 Breakout

Shares of Computer Age Management Services (CAMS) fell nearly 3% on Tuesday following a tepid reaction to its fourth-quarter results and a bearish call from Citi.

CAMS, which provides tech-enabled services to mutual funds and other financial institutions, reported a net profit of ₹114 crore, marking a 10.1% year-on-year increase, while revenue rose 14.7% to ₹356 crore.

EBITDA grew by 11.2% to ₹159.3 crore, but the EBITDA margin declined slightly to 44.7%, down from 46.1% a year ago.

CAMS also declared a ₹19 per share dividend.

Despite the growth in headline numbers, analysts remain cautious.

Citi retained its ‘Sell’ rating with a target price of ₹3,055 — implying a 20% downside — citing a 10% quarter-on-quarter dip in core profit, slower non-mutual fund revenue growth, and concerns over pricing stability and short-term profitability pressures.

Motilal Oswal, however, maintains a more constructive long-term view. The brokerage expects structural tailwinds in the mutual fund industry to support absolute growth in MF revenues.

It also sees scope for the non-MF revenue share to rise over the next 3–5 years, aided by macro triggers and strategic investments.

From a technical perspective, SEBI-registered analyst Kavan Patel notes ₹3,900 as the key resistance level. “Only above this level can we expect fresh long positions to build,” he said, suggesting that the short-term trend hinges on a decisive breakout above this threshold.

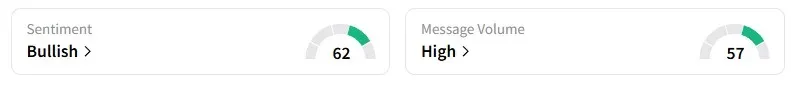

On Stocktwits, data shows that retail sentiment turned ‘bullish’ from ‘neutral’ a week ago.

CAMS shares have fallen 27% (YTD)

For updates and corrections, email newsroom[at]stocktwits[dot]c

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)