Advertisement|Remove ads.

Can ERNIE 5.0 Power Baidu’s Next Chapter? Benchmark Thinks So

Baidu Inc. (BIDU) received a price target cut from Benchmark analyst Fawne Jiang, who now values the Chinese tech firm at $115 per share, down from $120.

Despite the adjustment, Jiang maintained a ‘Buy’ recommendation, signaling continued confidence in Baidu’s long-term strategy amid a shifting business landscape, as per TheFly.

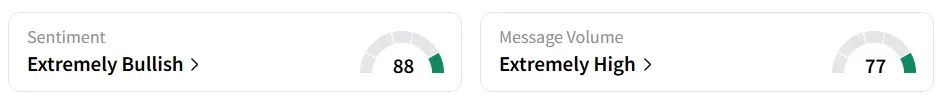

Baidu stock traded over 1% higher on Thursday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

A Stocktwits user said the company is a deep-value play in Chinese tech.

The price target change reflects ongoing challenges in Baidu’s primary advertising business, said the analyst, which has been grappling with sluggish growth. At the same time, the company is finding momentum in its non-advertising segments, driven by expansion in artificial intelligence and cloud services.

In the second quarter (Q2), Baidu's online marketing revenue decreased 15% year-on-year (YoY) to RMB16.2 billion ($2.27 billion), while the non-online marketing revenue jumped 34% YoY to RMB10.0 billion ($1.40 billion).

According to Benchmark, the softness in Baidu’s digital ad business is expected to limit near-term margin growth, especially as the company continues funneling capital into its artificial intelligence initiatives.

Jiang pointed to the upcoming debut of Baidu’s next-generation AI model, ERNIE 5.0, as a key milestone. The firm believes ERNIE’s launch will further justify the company’s strategic redirection.

Baidu’s strategy mirrors a larger trend among major tech companies worldwide, which are increasingly leaning on AI to offset weakness in traditional revenue areas.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)