Advertisement|Remove ads.

Capri Holdings Stock Reinstated At BofA After Q3 Earnings, But Retail's Downbeat

Shares of Capri Holdings Ltd. ($CPRI) rose more than 1% on Monday after BofA reinstated coverage of the luxury fashion group, but retail sentiment stayed downbeat.

BofA has a ‘Neutral’ rating on Capri shares with a $23 price target, Fly.com reported.

According to the analyst, even as Capri's business has been challenged, the potential for its brands to recover from a sales and margins trough "provides a counterpoint that balances" its "relatively bleak view of the near-term fundamentals," added the report. The analyst noted the sales and earnings decline for the past nine quarters.

Recently, Barclays also lowered the firm's price target on Capri Holdings to $19 from $21 with an ‘Equal Weight’ rating, citing its fiscal Q3 earnings miss and a slower-than-expected turnaround.

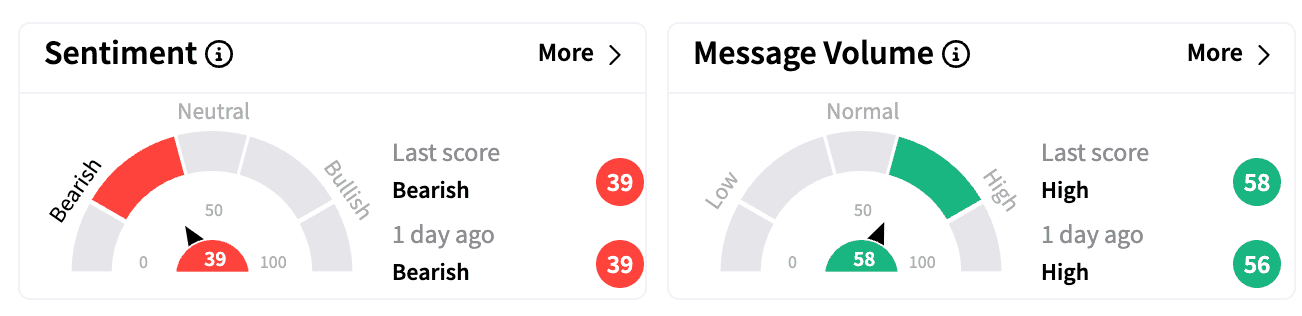

Sentiment on Stocktwits remained in the ‘bearish’ territory compared to a day ago. Message volumes stayed in the ‘high’ zone.

For Q3, Capri Holdings’ adjusted earnings per share came in at $0.45, missing estimates of $0.65. Its revenues fell about 11.6% to $1.26 billion, but were in line with Wall Street estimates.

Capri Holdings sees fiscal 2025 revenue of about $4.4 billion, below consensus estimates of about $4.51 billion, according to Fly.com. It expects FY26 revenue of around $4.1 billion.

Capri Holdings is a fashion luxury group that owns such brands as Versace, Jimmy Choo and Michael Kors.

Capri Holdings stock is up 2.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219715394_jpg_c787a7b591.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_martin_shkreli_jpg_4da92d4843.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)