Advertisement|Remove ads.

Capri Trims Full-Year Outlook, But Profit Grip And Strategic Divestitures Keep Bulls Around

Fashion and luxury goods retailer Capri Holdings (CPRI) lowered the outlook for sales and operating profit on Wednesday for its current fiscal year, citing tariff-related uncertainty and currency headwinds.

Still, a lesser-than-feared pressure on the company's bottom line is likely giving investors some confidence as the luxury retailer moves forward with its turnaround plan.

Capri Holdings, which owns the Michael Kors, Jimmy Choo, and Versace brands, has been working for years to divest certain units and reduce its debt burden following declines in sales, credit ratings, and stock performance.

Last month, it struck a deal to sell Versace to Italy's Prada for $1.4 billion.

Capri Holdings shares spiked before losing some of those gains to end 2.5% on Wednesday.

The company guided for adjusted earnings per share (EPS) of $0.1 to $0.15 in the ongoing quarter, above Wall Street expectations of $0.11.

EPS is expected to be between $1.20 and $1.40 on an adjusted basis for fiscal year 2026, also above analyst expectations of $1.02.

Top-line pressure, however, persists. Capri Holdings lowered its annual sales forecast to $3.3 billion to $3.4 billion, down from its previous estimate of $4.1 billion in February.

Revenue for the current quarter is expected to be between $765 million and $790 million, significantly lower than the Street's estimate of $959.9 million.

CEO John Idol said fiscal 2025 was challenging, but the company remains optimistic about fiscal 2026 thanks to its turnaround program, which he said is beginning to show positive signs.

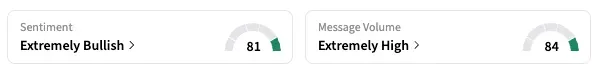

On Stocktwits, retail sentiment shifted to 'extremely bullish' from 'neutral,' and message volume accelerated similarly.

A user said Capri Holdings is “generating good free cash flow and will be a debt free company soon."

However, one user reacted negatively to the earnings report, saying, “Why this CEO still has a job is beyond imagination."

Capri Holdings shares are down 14.3% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ethereum_OG_jpg_57ba235889.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_transocean_OG_jpg_4d836b625f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Gold_bars_02f67954d1.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)