Advertisement|Remove ads.

Carnival Stock Dips As Q4 Net-Yield Growth, Profit Outlook Miss Estimates: But Retail’s Not Bothered

Shares of Carnival Corp. (CCL) were trading over 3% lower on Monday, paring earlier losses of up to 6.5%, following the release of its third-quarter earnings.

Despite posting an EPS of $1.27, which surpassed estimates of $1.16, and a record $7.89 billion in revenue (vs. a $7.81 billion estimate), the stock slipped after the company issued a softer-than-expected forecast for Q4 net yields and profits.

Carnival raised its full-year EPS guidance for the third time this year to $1.33, higher than the consensus of $1.21.

“We delivered a phenomenal third quarter, breaking operational records and outperforming across the board. Our strong improvements were led by high-margin, same-ship yield growth, driving a 26 percent improvement in unit operating income, the highest level we have reached in fifteen years," said CEO Josh Weinstein.

However, Carnival’s Q4 outlook fell short of investor expectations, with the company projecting net yield growth of around 5%, lower than the FactSet consensus of 5.8%. The Q4 adjusted EPS forecast of $0.05 also came in lower than the expected $0.07.

But for the full fiscal year, the company raised its guidance for net yields to 10.4% from 10.25%.

The cruise operator has been riding a wave of momentum since its last quarter, where it reported record customer deposits of $8.3 billion, driven by strong demand and higher pricing for its cruise itineraries.

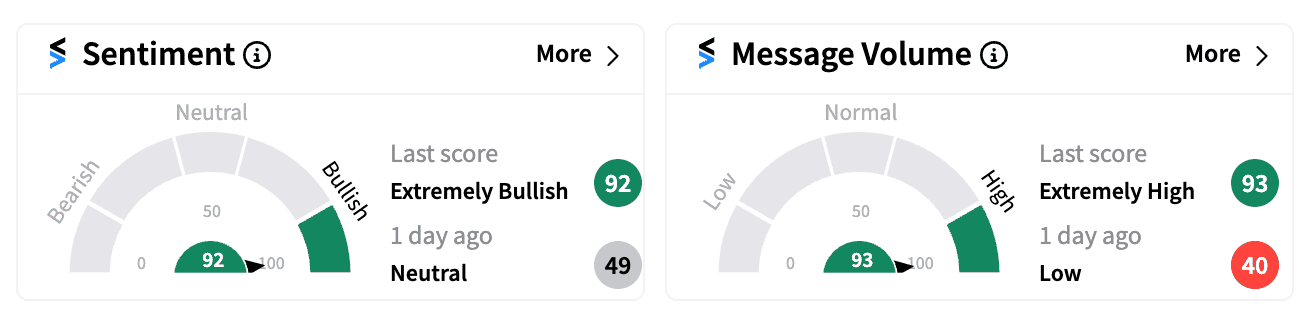

Retail sentiment on Stocktwits turned ‘extremely bullish’ as users shrugged off broader market concerns and focused on the bigger picture.

The cruise operator’s debt spiked from $11.5 billion in 2019 to $34.5 billion in 2022. However, the company has managed to reduce it by $5 billion since then.

Year-to-date, Carnival shares are up over 4%, though they trail competitors Norwegian Cruise Line (up 12%) and Royal Caribbean (up 45%).

Read next: AMC Stock Rises, Boosts Retail Sentiment: But It’s Not The ‘Roaring Kitty’ Effect This Time

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Meta_jpg_0f17dacb20.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244842667_jpg_931c352b95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)