Advertisement|Remove ads.

AMC Stock Rises, Boosts Retail Sentiment: But It’s Not The ‘Roaring Kitty’ Effect This Time

Shares of AMC Entertainment Holdings (AMC) climbed over 1% on Monday morning after the theater chain revealed it had extinguished over $152 million in unsecured debt through a series of privately negotiated deals between Aug. 5 and Sept. 30.

This follows a major debt restructuring in July, which extended $2.45 billion in debt maturities from 2026 to 2029 and beyond.

AMC, still grappling with about $4 billion in debt, has been navigating a challenging environment made worse by the 2023 Hollywood strikes.

Despite a smaller-than-expected loss in the second quarter, its high debt load limits financial flexibility.

However, the company has reportedly been gaining market share and benefiting from its “meme-stock” legacy, which has enabled it to raise funds without taking on more debt, by issuing more stock.

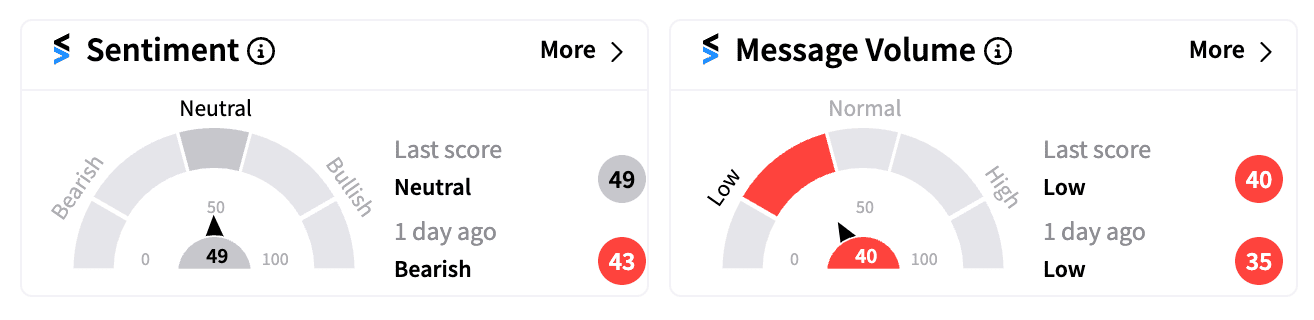

On Stocktwits, retail sentiment toward AMC improved from ‘bearish’ to ‘neutral’ on Monday, as investors responded positively to the latest debt reduction efforts.

Since the “meme-stock” frenzy sparked by influencer Keith Gill, aka “Roaring Kitty,” AMC’s retail base has played a significant role in triggering short squeezes.

Notably, institutional investors own just 28% of AMC shares and retail investors control the majority, continuing to shape the company’s share price movements.

However, AMC has had a tough 2024, with shares down over 25% year-to-date, in contrast to the S&P 500’s 20% gains.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Meta_jpg_0f17dacb20.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244842667_jpg_931c352b95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)