Advertisement|Remove ads.

Carnival Gets Price-Target Hikes After Q3 Earnings: Stock Rises, Retail Sentiment Near Year’s High

Shares of Carnival Corp. (CCL) rose nearly 0.4% pre-market on Tuesday after the company’s Q3 earnings report sparked mixed reactions.

On Monday, the stock initially dropped more than 6% but pared some losses to close slightly in the red after a softer-than-expected forecast for current-quarter net yields and profits overshadowed a profit beat and record quarterly revenue, dampening market sentiment.

Despite the cautious outlook, Carnival raised its full-year profit guidance for the third time this year and lifted its net yield forecast to 10.4%, up from 10.25%.

Barclays raised its price target on Carnival to $26 from $25, representing about 40% upside from current levels, while maintaining an ‘Overweight’ rating.

The brokerage noted that while the Q3 results didn’t meet all expectations, strong demand and positive commentary keep Carnival’s 2025 outlook intact.

Morgan Stanley also adjusted its price target, raising it to $16.50 from $15, but stuck with an ‘Underweight’ rating.

The brokerage increased its EPS forecasts for FY24, FY25, and FY26 but expressed concerns about Carnival’s asset-heavy model and high financial leverage, which could make it more vulnerable to a potential slowdown compared to other travel names.

Carnival has made progress on reducing its pandemic-era debt, which ballooned from $11.5 billion in 2019 to $34.5 billion in 2022. Since then, the company has reduced its debt by $5 billion.

But on Monday, CEO Josh Weinstein expressed confidence in the company’s future, pointing to “enhanced commercial execution” and strong booking momentum, positioning Carnival for a solid 2025 and beyond.

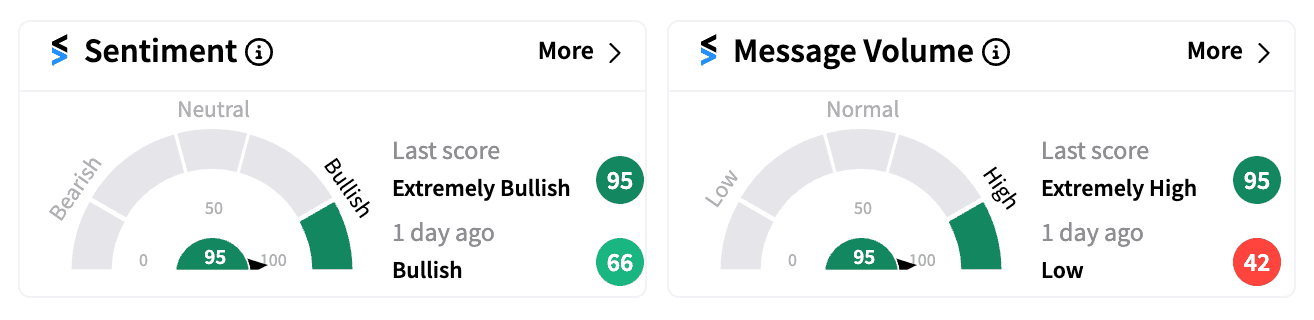

On Stocktwits, retail sentiment surged to ‘extremely bullish’ (95/100) levels, nearing the highest point this year, with a 36% spike in message volume.

One user commented on the bullish outlook, noting the stock’s recovery and positive future trend.

Another user looked ahead to a higher target price.

Shares of Carnival are up over 6% year-to-date, as of Monday’s close, compared to Norwegian Cruise Line’s (NCLH) 12% gain and Royal Caribbean’s (RCL) 47% surge.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)