Advertisement|Remove ads.

Cellectar Biosciences Stock Drops 17% On $5.8M Fundraise: Retail Awaits An ‘Impending’ Rally

Cellectar Biosciences (CLRB) stock tumbled over 17% on Tuesday after the company announced an agreement with several institutional investors to exercise certain existing warrants for gross proceeds of approximately $5.8 million.

Cellectar stated that a total of 1.05 million existing warrants were exercised. The company now intends to use the net proceeds for working capital and general corporate purposes in addition to funding the early-stage trial of its CLR 125 compound in triple-negative breast cancer.

The capital raise comes on the heels of Cellectar announcing that it intends to submit a conditional marketing authorization application to the European Medicines Agency for Iopofosine I 131 as a treatment for refractory Waldenstrom macroglobulinemia in early 2026, following advice from the agency’s Scientific Advice Working Party (SAWP).

The company stated that it anticipates European Approval by 2027 and commercial availability of the therapy in the 30 countries represented by the EMA in the same year.

“We believe this regulatory success is substantial as it further supports Cellectar’s plans to pursue worldwide approval, including a New Drug Application (NDA) with the U.S. Food and Drug Administration (FDA) under an accelerated approval pathway,” CEO James Caruso said on Monday, while noting that an NDA submission is contingent upon the company obtaining additional funding to initiate a confirmatory trial.

Oppenheimer, which has a ‘Perform rating’ on CLRB shares, subsequently noted that the news is a substantial positive catalyst that should bolster the company’s efforts to partner the Iopofosine I 131 program.

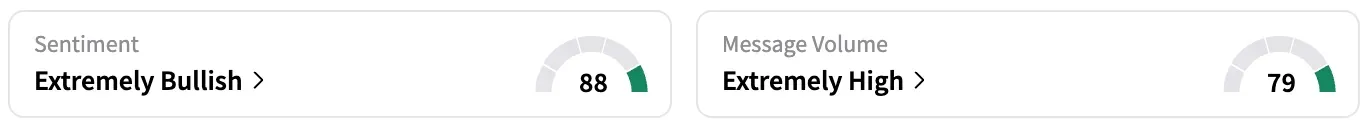

On Stocktwits, retail sentiment around CLRB jumped from ‘bullish’ to ‘extremely bullish’ territory over the past 24 hours, while message volume rose from ‘high’ to ‘extremely high’ levels.

A Stocktwits user dismissed the decline in the stock price.

Another user expressed hopes about an impending rally in the shares.

CLRB stock is down 43% this year and approximately 92% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)