Advertisement|Remove ads.

Celsius, Cassava Sciences, Palantir: Top Trending Stocks Retail Is Eyeing Pre-Market After Monday Rout

Tuesday's trading session promises to be another rollercoaster ride for investors, following Monday's historic sell-off. While the broader market remains jittery, retail investors are turning their attention to specific stocks with pre-market movements and upcoming events.

Here's a breakdown of the top three stocks catching retail investor interest on Stocktwits, as of 7 am ET:

Celsius Holdings Inc. (CELH)

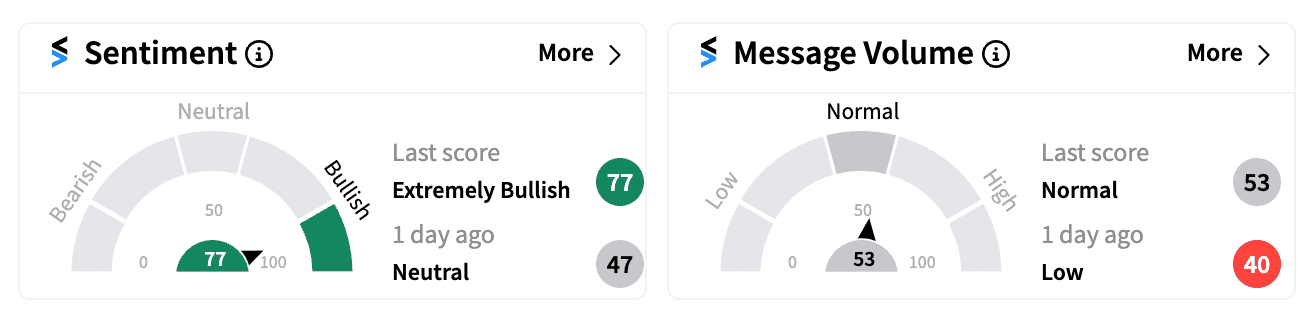

The energy drink maker is a clear winner pre-market, surging over 10% to $45.70 after exceeding revenue, EPS and gross margins expectations in its Q2 earnings report. That has prompted a surge in retail investor optimism on Stocktwits.

Retail sentiment flipped from neutral to extremely ‘bullish’ (77/100), with some watchers praising the company's operational strength and potential for a buyback program.

John Fieldly, Chairman and CEO, stated, "Celsius today reported its best second-quarter financial results ever, delivering records in revenue, gross profit, and gross margin.” Still, CELH remains down nearly 30% year-to-date. But early data suggests retail is considering ‘buying the dip.’

Cassava Sciences Inc. (SAVA)

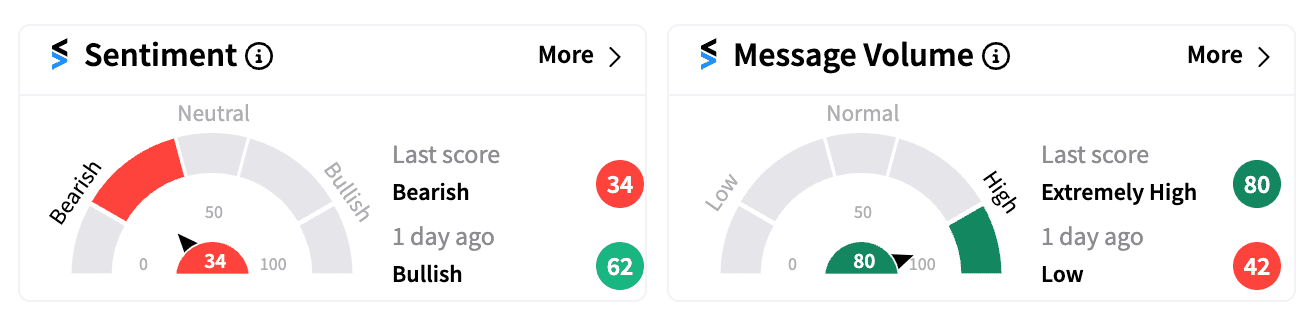

The biotech company is in a complex situation. While the stock price has seen a pre-market jump, retail investor sentiment flipped to ‘bearish’ (34/100) with extremely high message volumes.

The company is facing scrutiny over its Alzheimer's drug candidate, simufilam, following the dismissal of a defamation lawsuit against short sellers who questioned it and the resignation of key C-suite executives.

Despite these headwinds, SAVA's upcoming Q2 earnings report after market hours on Wednesday will be closely watched, as the company aims to advance its Phase 3 trials for simufilam.

The company will also hold a conference call on Thursday, August 8, to discuss recent developments.

Wall Street expects Cassava to post a loss of $0.41 per share. Although the stock has given up some gains following the short report, it remains up over 56% year-to-date.

Palantir Technologies Inc. (PLTR)

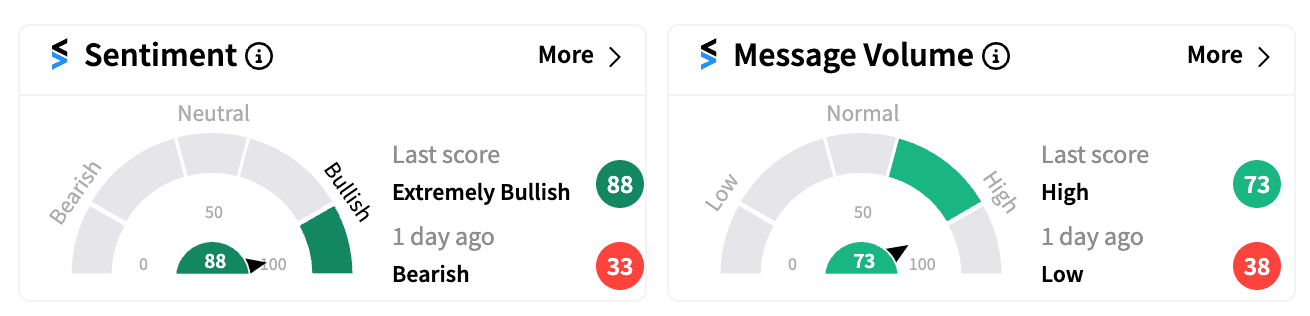

The AI software provider’s stock price surged over 10% pre-market, following strong Q2 earnings, which included increased revenue and adjusted operating income guidance that surpassed Wall Street estimates.

Stocktwits data mirrored management’s optimism, with retail sentiment on PLTR soaring into ‘extremely bullish’ territory (88/100) from bearish levels seen as a side effect of the broader market rout.

CEO Alex Karp described the earnings report as “historic” for Palantir, which provides data analysis tools to companies and governments. He noted that Palantir’s AI platform, launched just over a year ago, has already transformed its business.

On Tuesday, Wedbush raised its price target on Palantir to $38 from $35, maintaining an Outperform rating. Deutsche Bank and DA Davidson also increased their price targets on PLTR. The stock is up over 45% year-to-date, and retail and Wall Street are both in agreement that there’s more potential upside ahead.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)