Advertisement|Remove ads.

Cero Therapeutics Rockets On FDA Orphan Drug Status For Blood Cancer Drug; Retail Bulls Feel Stock 'Still Has A Few Pumps Left'

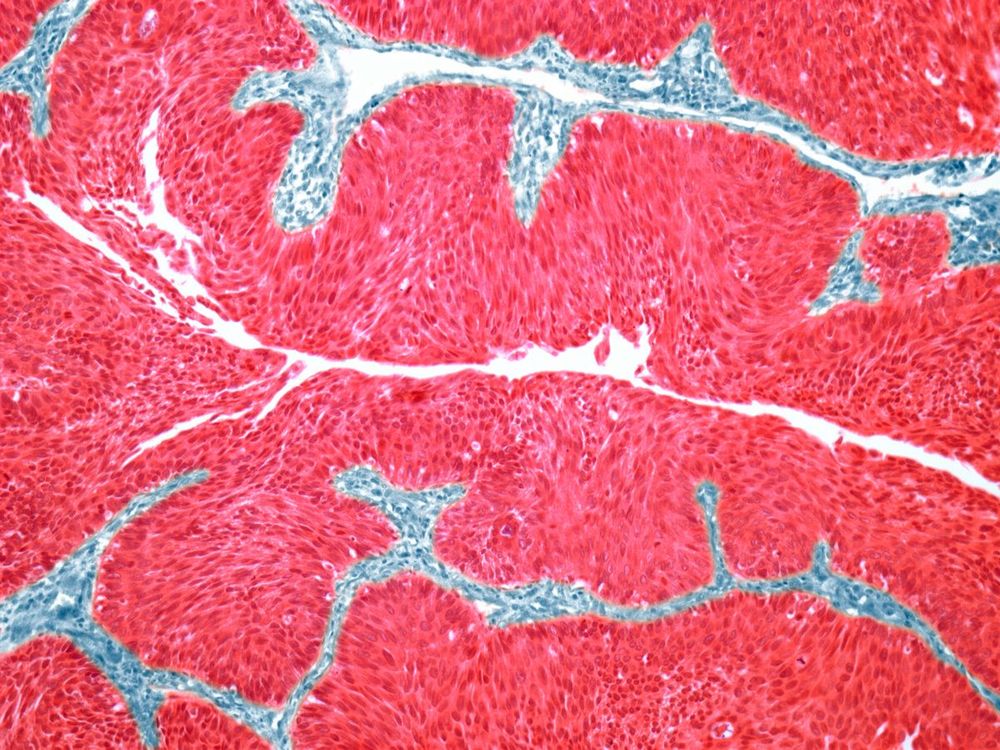

Shares of Cero Therapeutics Holdings drew increased retail investor chatter on Tuesday after the company said that the FDA granted orphan drug designation to its lead candidate, CER-1236, for treating acute myeloid leukemia (AML).

The stock soared 189% to $19.83 in the regular session, but fell by 15% in after-hours trading.

The Phase 1/1b, open-label, multi-center clinical trial will assess the safety and initial efficacy of CER-1236 in patients with relapsed or refractory AML, remission with measurable residual disease, or newly diagnosed with TP53-mutated MDS/AML or AML.

The study will include a dose escalation to determine the recommended Phase 2 dose and an expansion phase.

Major objectives include the frequency of adverse events, dose-limiting toxicities, estimated overall and complete response rates, and measurable residual disease. Minor objectives include pharmacokinetics.

The company said CER-1236 is designed to engineer a patient’s T cells to use phagocytic mechanisms — or target-cell “eating” — in addition to T cell destruction mechanisms.

The Orphan Drug designation includes FDA assistance in clinical trial design, grants, a waiver of drug application fees, and seven years of market exclusivity upon approval.

On Stocktwits, retail sentiment was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said they had accumulated shares from $8 to $15 and were still holding 4,700 shares, undecided on whether to carry the position overnight.

Another user pointed to the stock's sharp gains, suggesting that after-hours moves were less meaningful for low-float names like Cero, which they believed could see additional upside.

Cero stock has declined 83.8% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ulta_beauty_resized_jpg_019f5f3947.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Amazon_Prime_Day_jpg_2330a8fab1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_HOOD_d1ea23b45e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210271447_jpg_cc4a4c2122.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2183291686_jpg_0cf9c99142.webp)