Advertisement|Remove ads.

CNS Pharmaceuticals Stock Declines On Wider Q1 Loss: But Retail Stays Unmoved

Shares of CNS Pharmaceuticals, Inc. (CNSP) declined 5% on Friday morning after the company reported wider losses in the first quarter (Q1).

The firm’s net loss for the three months ended March 31, 2025, was approximately $4.3 million, compared to approximately $3.5 million for the comparable period in 2024.

The company said the increase in net loss is largely attributable to the costs of data clean-up, preparation, and analysis for the topline primary data release on the Berubicin trial in brain cancer.

CNS Pharmaceuticals’ research and development expenses rose to $3.2 million in the quarter, while general and administrative expenses fell marginally to $1.09 million, owing to a decrease in stock-based compensation, marketing, advertising, and insurance expenses.

The company ended the quarter with cash of approximately $13.1 million. CNS believes that the cash on hand as of March 31, 2025, in addition to the $5 million raised from a public offering earlier this month, is sufficient to fund planned operations into the second half of 2026.

CNS is developing treatments for cancers in the brain and central nervous system. By year-end, the company intends to commence the phase 2 study of its lead program, TPI 287, for treating Glioblastoma Multiforme (GBM). Glioblastoma multiforme (GBM) is the most common form of cancer that originates in the brain.

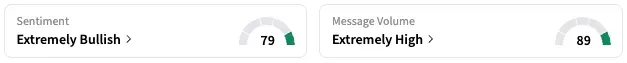

On Stocktwits, retail sentiment around CNSP remained ‘extremely bullish’ over the past 24 hours while message volume remained at ‘extremely high’ levels.

CNSP stock is down by 80% this year and over 99% over the past 12 months.

Also See: Novo Nordisk CEO Lars Jørgensen Steps Down Amid Challenges, Retail Chatter Spikes

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)