Advertisement|Remove ads.

Cocoa Prices, Analyst Revisions Weigh On Hershey's Stock Ahead Of Q4 Earnings: Retail Sentiment Downbeat

Shares of the Hershey Co. ($HSY) slipped to a year-low on Monday as the company navigates an uncertain phase amid analyst price target revisions and management changes ahead of its fourth-quarter earnings, dragging down retail sentiment.

Hershey’s stock has come under pressure recently after its president and CEO Michele Buck announced her retirement in June. The company has begun looking for a successor.

Wall Street analysts expect the company to post $2.37 in earnings per share on revenue of $2.84 billion, according to Stocktwits data.

On Monday, Bernstein lowered the firm's price target to $146 from $177 with a ‘Market Perform’ rating, in anticipation on its EPS guidance for 2025, Fly.com reported.

According to the firm, cocoa input costs continue to be high weighing on the need for the company to plan hedging alternatives, added the report. Meanwhile, Bernstein SocGen cut its price target to $146; Deutsche Bank dropped its PT to $148.

Last week, Piper Sandler issued a downgrade to Hershey from ‘Neutral’ to ‘Underweight’ with a $120 price target at

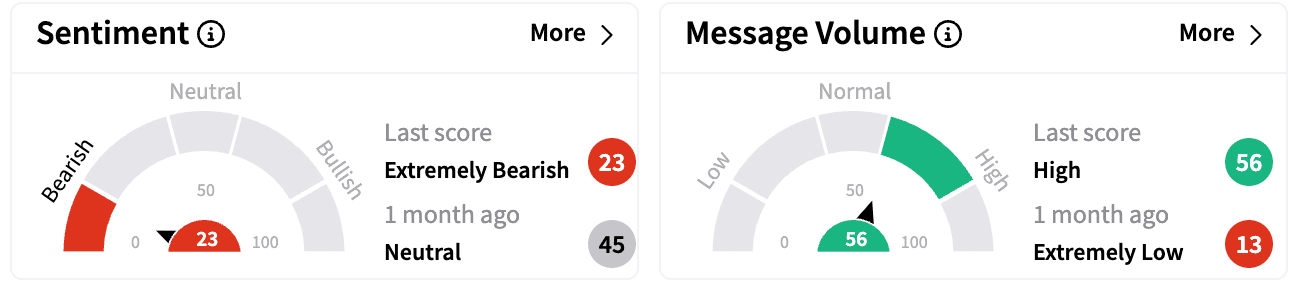

Sentiment on Stocktwits dropped to ‘extremely bearish’ from ‘neutral’ a month ago. Message volumes rose to ‘high’ from ‘extremely low’

One user on Stocktwits thought the company still offered a safe haven in the form of dividends.

Recently, confectionery company Mondelez International ($MDLZ) made a takeover bid that wassubsequently rejected by the Hershey trust.

Hershey has more than 90 brand names in about 80 countries that drive more than $11.2 billion in annual revenues, including Hershey's, Reese's, Kisses, Kit Kat, Jolly Rancher, Twizzlers and Ice Breakers.

Hershey's stock is down 12.73% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)