Advertisement. Remove ads.

Capital One Stock Falls Ahead of Q3 Earnings: Retail Turns Cautious

Shares of Capital One ($COF) were down nearly 1% (12:58 pm) on Thursday afternoon ahead of the financial services firm’s third-quarter earnings.

The McLean, Va-based company is expected to report earnings per share (EPS) of $3.77 on estimated revenues of $9.88 billion for the third quarter.

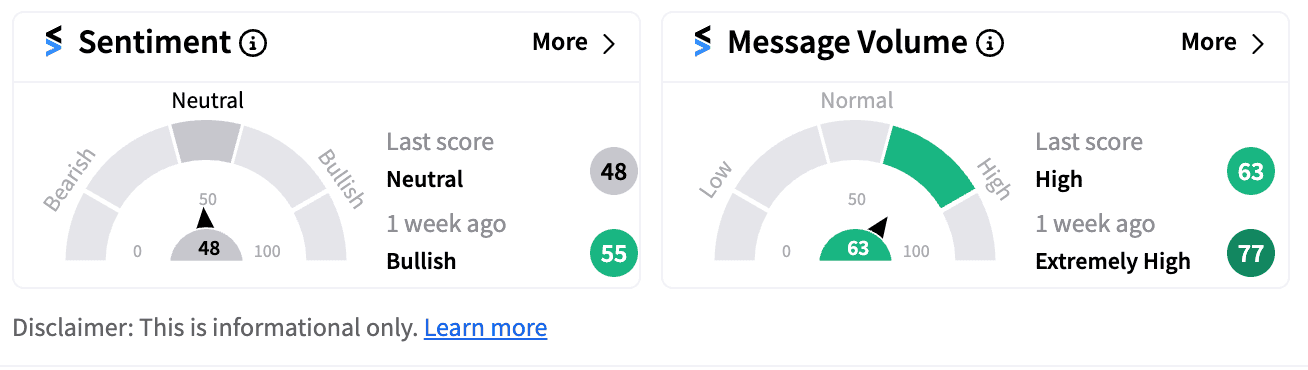

Retail sentiment on the stock has turned ‘neutral’ (48/100) from ‘bullish’ (53/100) a week ago. Message volumes have dipped from ‘extremely high’ to ‘high.’

According to consensus Wall Street estimates, Capital One’s net interest margin is expected to reach 6.9%, slightly up from 6.7% from a year ago, Zacks Equity Research reported. Its efficiency ratio is pegged at 52.5, up from 51.9% last year. The firm’s tier 1 capital ratio is expected to reach 14.8%, up from 14.3%, Zacks reported citing analysts.

On Wednesday, New York Attorney General Letitia James was said to be investigating Capital One's proposed $35.3 billion acquisition of Discover Financial Services ($DFS) on potential violations of state antitrust laws.

Bloomberg first reported on the news of the probe, citing James’s take on the merger and its potential impact as both Capital One and Discover have over $16 billion in credit card loans in the state.

Keefe Bruyette analyst Sanjay Sakhrani has said the investigation "could signal a coordinated advocacy deal opposition by parties opposed to the deal," resulting in pressure on the situation and the stocks, The Fly reported.

COF stock is 15.73% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/08/gst-2025-08-0c85e16a4defd813c05e7fa63217dff5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/02/m-nagaraju-2025-02-e1c6095fe8963ea5707d968048b969f4.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/09/nclt-2024-09-368a6a429d0365fddd99a6ca5bbf067a.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2018/06/2018-06-21T050845Z_1_LYNXMPEE5K0CB_RTROPTP_4_INDIA-ECONOMY-INFLATION.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/03/France-Gold.jpg)