Advertisement|Remove ads.

Colgate Q2 Results Miss Estimates: Analysts See Potential Recovery If This Support Holds

- Q2 net profit fell 17.1% YoY to ₹327.5 crore on weak demand and GST-related disruptions.

- The stock is trading near a critical multi-decade support level.

- Analysts remain cautious, flag ₹2,152-₹2,400 as a critical zone for the stock.

Shares of Colgate-Palmolive (India) fell 3.8% to ₹2,200 on Friday, after the FMCG giant posted weak Q2 results.

Net Profit Declines 17.1%

The company’s net profit declined 17.1% year-on-year (YoY) to ₹327.5 crore from ₹395.1 crore. Adjusted for a one-time tax refund impact in the base period, profit was down 7.2%. Revenue for the quarter slipped 6.2% to ₹1,519.5 crore compared to ₹1,619 crore a year ago.

EBITDA declined 6.6% to ₹464.5 crore from ₹497.4 crore, with operating margins largely stable at 30.6%. The board also declared a dividend of ₹24 per share.

Sequentially, net sales improved 6.1% from the June quarter, indicating early signs of recovery in demand.

“While we continued to navigate through a difficult operating environment, our second-quarter performance also reflects the transitory disruption at distributors and retailers across channels caused by the GST rate revision. Our first half performance cycles a high base of double-digit net sales growth in the base period and we expect a gradual recovery in performance in the second half,” said MD and CEO, Prabha Narasimhan.

Technical Analysis

Colgate’s stock is currently trading near a multi-decade support level at the 200-week moving average. If the stock holds this support and consolidates, there is potential for a trend reversal toward ₹2,500, said SEBI-registered analyst Front Wave Research.

The stock remains in a downtrend, consolidating within the ₹2,152-₹2,400 range. A break below ₹2,152 could trigger a fall toward ₹2,050 - ₹2,100, but stronger volume is needed to confirm the move, added SEBI-registered Financial Sarthis.

What Is The Retail Sentiment?

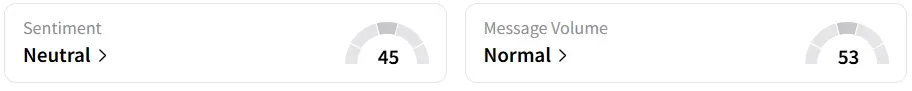

Despite the intraday declines, retail sentiment on Stocktwits shifted to ‘neutral’ from ‘bearish’ a day earlier.

YTD, the stock has fallen over 17%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)