Advertisement|Remove ads.

Conagra Stock’s Retail Following Stays Optimistic Even After Supply Chain Disruptions Prompt 2025 Outlook Cut

Shares of Conagra Brands Inc. (CAG) were in the spotlight over the weekend as the branded foods company cut its annual earnings per share and operating margin forecast due to supply chain and customer service interruptions, but retail sentiment remained optimistic.

According to a company statement, its third-quarter saw supply constraints for two of its product platforms: frozen meals containing chicken, and frozen vegetables.

Additionally, the company also experienced some foreign exchange-related challenges that are likely to impact its adjusted earnings per share (EPS).

Specifically, the company experienced manufacturing challenges at the primary facility that prepares and cooks chicken used in frozen meals.

It had previously planned to implement substantial modernizing upgrades to this facility in the summer of 2025 that remain on track, targeted for completion by the end of the first quarter of fiscal 2026.

The frozen vegetables segment, meanwhile, saw “higher-than-anticipated” demand that depleted inventory-on-hand and led to “out-of-stocks” at stores.

The company now expects 2025 net sales to decline by about 2%, worse than the previous projection of a 1.5% to flat range. It expects EPS to be about $2.35, lowered from $2.45 to $2.50 projected earlier. That compares to consensus EPS estimates of $2.46.

Its adjusted operating margins are expected to be around 14.4%, down from 14.8% earlier. Expectations for capital expenditures and free cash flow remain unchanged.

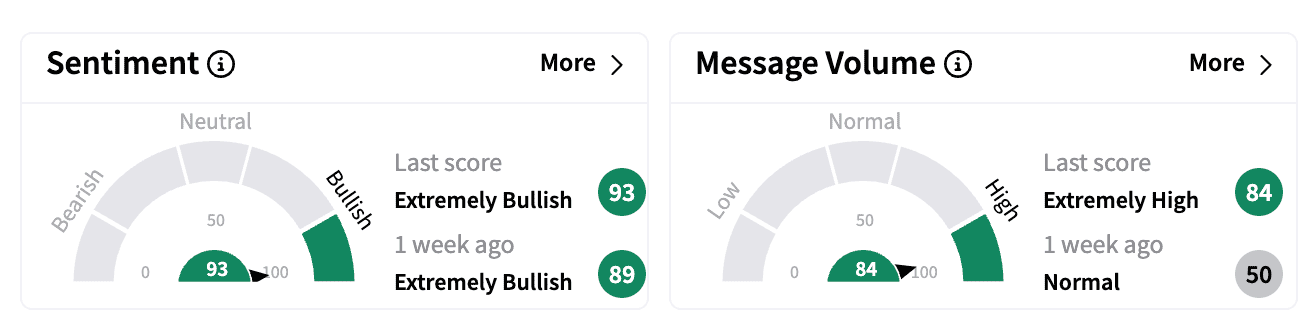

Sentiment on Stocktwits inched up in the ‘extremely bullish’ zone. Message volume moved to ‘extremely high’ from ‘normal.’

"We are pleased with the strong and consistently improving demand we have experienced this year as a result of those investments. While we've faced recent challenges servicing that demand, our investments in infrastructure and strategic partnerships position us for long-term success," said Sean Connolly, president and CEO of Conagra Brands.

Conagra’s brands include Healthy Choice, Hunt's, and Birds Eye, among others.

Conagra stock is down 8.9% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)