Advertisement|Remove ads.

Confluent’s Sale Could Bring 30% Premium, Says Raymond James

Confluent Inc.’s (CFLT) reported sale exploration move has led Raymond James to believe that the company could fetch a premium exceeding 30% over its current market value, given its growth trajectory and strategic assets.

A Reuters report cited that Confluent was working with an investment bank on the sale process, following interest from private-equity firms and other technology companies.

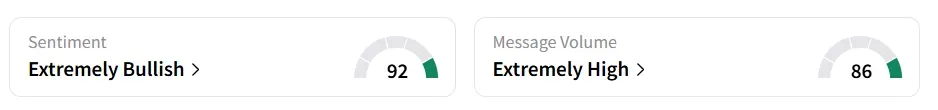

Confluent stock traded over 10% higher on Wednesday morning. On Stocktwits, retail sentiment around the stock improved to ‘extremely high’ from ‘bullish’ territory the previous day. Message volume jumped to ‘extremely high’ from ‘normal’ levels in 24 hours.

The stock experienced a 475% increase in user message count in the last 24 hours, as per platform data. A bullish Stocktwits user said the move could lead to a 10x increase in the company’s value if it finds the right buyers.

In a research note, Raymond James analyst Mark Cash said that Confluent is being eyed as an acquisition target, triggered by compressing valuation multiples and its strategic role in the AI and data ecosystem.

Confluent offers a data system that helps companies stream live data from many sources across their entire organization. This setup is especially useful for powering artificial intelligence (AI) tools.

According to the report, though Confluent’s valuable technology has attracted strong interest, the company became a takeover target after its stock dropped in July, following news that it had lost a major customer.

The company is expected to report third-quarter results on October 27. It sees a subscription revenue of between $281 million and $282 million.

Confluent stock has lost over 17% in 2025 and gained 16% in the last 12 months.

Also See: Verizon Eyes Urban Growth With Starry Wireless Acquisition

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)