Advertisement|Remove ads.

Constellation Brands Stock Dips As Wall Street Frets Over Beer Business, But Retail Finds Confidence In Buffett’s Backing

Shares of Constellation Brands (STZ) fell more than 2% on Thursday as the Corona beer maker received another analyst downgrade, but retail sentiment stayed upbeat.

On Thursday, Morgan Stanley downgraded Constellation Brands to ‘Equal Weight’ from ‘Overweight’ with a price target of $202, reduced from $220, the Fly reported.

According to the firm, although the company’s "already compressed" valuation "looks reasonable," there are concerns about beer growth in the long term. The analyst also noted that falling demand for alcohol consumption from the younger generation, rise of cannabis use, and muted category growth were factors behind the downgrade.

Constellation’s stock, along with several other alcohol and spirit companies, came under pressure recently after the U.S. Surgeon General Vivek Murthy issued an advisory linking cancer to alcohol consumption.

According to a recent Gallup poll, in the past two decades, consumers under 30 have been less inclined to drink alcohol at all. Only about 62% of adults under 35 reported they drank, down from 72% two decades ago from 2021 to 2023, Business Insider reported citing the poll.

Trump tariffs also weigh on Mexican imports. Constellation’s Mexican beer brands, Corona and Modelo, are widely expected to take a hit as a result.

Last week, Piper Sandler downgraded Constellation Brands to ‘Neutral’ from ‘Overweight’ with a price target of $200, down from $245, following the imposition of 25% of tariffs on all Mexican imports. Constellation's multiple also reflected uncertainty from tariff risk exposure and weaker sales momentum.

Constellation could see a potential $3.00-3.75 hit to fiscal 2026 earnings per share EPS if the tariffs lasted a full fiscal year, according to the firm, noting that potential pricing and volume headwinds make it difficult to precisely estimate.

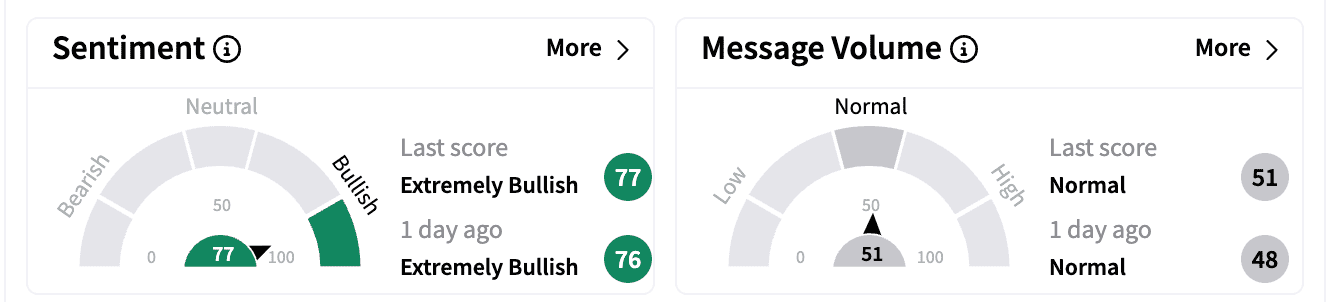

Reaction on Stocktwits to the downgrade was muted, with sentiment remaining in the ‘extremely bullish’ zone. Message volume was in the ‘normal’ zone.

One user was optimistic given Warren Buffet’s recent investment in the company.

Warren Buffet’s Berkshire Hathaway recently bought 5.6 million shares worth about $1.24 billion in the beer and wine maker.

Constellation stock is down nearly 22% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es8_jpg_6097d170b7.webp)