Advertisement|Remove ads.

Constellation Energy Stock Gains On Q4 Beat, Bullish 2025 Outlook – Retail’s Not Impressed Yet

Constellation Energy (CEG) shares rose nearly 1% on Tuesday after the company reported a fourth-quarter profit, reversing a loss from the prior year despite weaker revenues. The company also reaffirmed its fiscal 2025 adjusted earnings outlook.

The nuclear energy provider posted earnings per share (EPS) of $2.44, beating the $2.14 consensus estimate, according to Koyfin.

Revenue reached $5.38 billion, exceeding the expected $4.75 billion.

The company also reported a net profit of $852 million, compared to last year's loss of $36 million, attributing the gains to its strong operational performance, with its nuclear fleet achieving a 94.6% capacity factor for 2024.

Constellation also noted it remains the largest producer of emissions-free energy in the U.S. for the 11th straight year.

"For the second consecutive year since forming our new company, Constellation has outperformed the top end of its guidance range – a testament to the combined value of our commercial and generation businesses, which were firing on all cylinders in 2024," said CFO Dan Eggers.

For the full year, Constellation reported adjusted earnings of $8.67 per share, significantly above its twice-revised guidance range of $8.00 to $8.40.

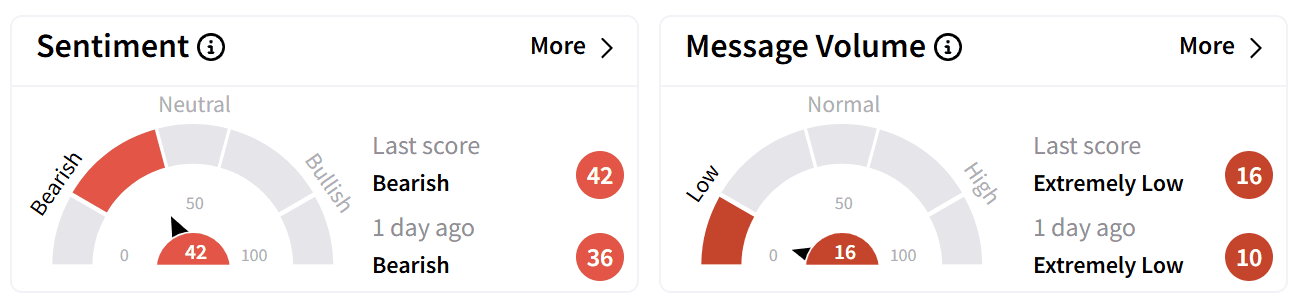

Following the earnings report, retail sentiment on Stocktwits climbed higher but remained in the ‘bearish’ zone accompanied by ‘extremely low’ levels of chatter.

Looking ahead, Constellation reaffirmed its 2025 earnings guidance of between $8.90 and $9.60 per share, compared to the analyst consensus of $9.43.

The company plans to invest over $2.5 billion in 2025 to maintain operational reliability and fund growth projects to meet rising power demand.

Last year, Constellation signed its largest-ever power purchase agreement with Microsoft, to repon Unit 1 of the Three Mile Island nuclear power plant by 2028.

Constellation’s shares have gained 41% year-to-date, more than doubling in value over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)