Advertisement|Remove ads.

Coty Stock Falls Ahead of Q2 Earnings: Retail Sentiment Downbeat

Shares of Coty Inc. ($COTY) have fallen 5.19% in the past week, ahead of the beauty products company’s second-quarter earnings, dampening retail sentiment.

Recently, Citi lowered its price target $7.50 from $8 with a ‘Neutral’ rating as part of its Q4 earnings preview for the larger beverages, household, and personal care sector, Fly.com reported.

According to Citi, most companies are likely to see their 2025 earnings growth outlooks fall to low- to mid-single-digits as the dollar faces currency challenges and Trump tariffs kick in, warned the report.

Meanwhile, Barclays lowered its price target to $6 from $7 with an ‘Underweight’ rating as part of a consumer staples preview by the firm.

According to Finchat, mean estimates for Q2 earnings per share stand at $0.08 on revenue of $1.40 billion.

Last quarter, the company missed EPS estimates by 18%, coming in at $0.15, according to Stocktwits data. However, its revenues of $1.67 billion, were in line with Wall Street estimates. In the first quarter, Coty's net revenues grew 2% on a reported basis and included a 1% headwind from FX and a 1% headwind from the divestiture of the Lacoste license.

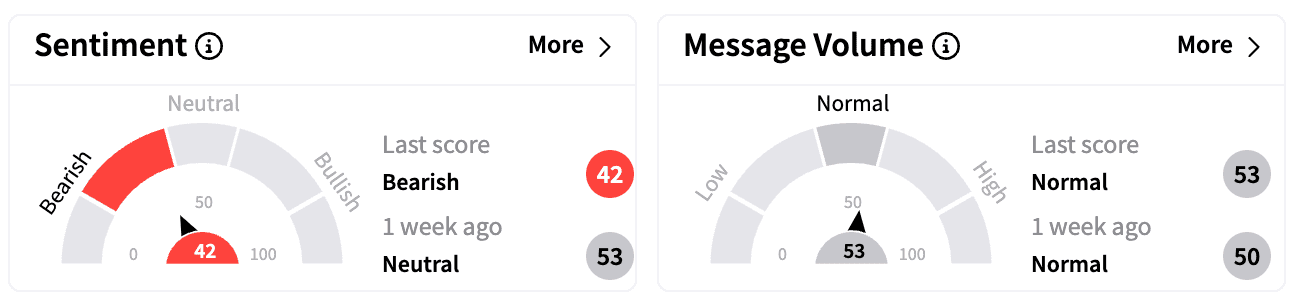

Sentiment on Stocktwits worsened to ‘bearish’ from ‘neutral’ one week ago. Message volumes remained in the ‘normal’ zone.

Coty has missed revenue estimates twice out of the past four quarters and EPS estimates thrice

"As we enter FY25, the macroeconomic environment remains as complex as ever and the outsized growth of the last few years is now entering the normalization phase,” Sue Nabi, Coty's CEO said after Q1 earnings.

Coty’s portfolio of beauty brands includes fragrance, color cosmetics, and skin and body care. Coty serves consumers with mass market products in over 120 countries and territories.

Coty stock is down 2.87% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)