Advertisement|Remove ads.

Couchbase To Merge With Haveli Investments In $1.5B Take‑Private Transaction, Draws Retail Applause

Software company Couchbase, Inc. (BASE) has agreed to be acquired by Haveli Investments for about $1.5 billion in an all-cash transaction, marking a significant shift as the company transitions from public to private ownership.

The company’s shares surged over 29% on Friday after the announcement.

Under the agreement, Couchbase shareholders will receive $24.50 in cash per share, a 29% increase over the stock’s closing price on June 18, 2025, the final full trading day before the deal’s announcement.

Haveli Investments, a private equity firm based in Austin, focuses on technology-sector investments, particularly in software, data, and gaming.

It partners with companies across all stages, offering strategic and operational support to fuel growth and profitability.

"The data layer in enterprise IT stacks is continuing to increase in importance as a critical enabler of next-gen AI applications," said Senior Managing Director at Haveli Investments, Sumit Pande.

Couchbase’s Capella platform is designed to meet the growing demands of AI-driven industries. By combining multiple workloads into a unified, scalable system, it offers flexibility, performance, and cost-efficiency across cloud and edge environments.

The company has the option to entertain superior acquisition proposals through June 23, 2025, under a “go‑shop” clause. Its board can terminate the deal if a better offer emerges, though there’s no guarantee one will appear during the window.

The acquisition has been greenlit by Couchbase’s board and is expected to finalize in the second half of 2025, pending shareholder approval and regulatory clearance. After closing, Couchbase shares will be delisted.

This move values Couchbase at $1.5 billion, shifting its focus away from public markets.

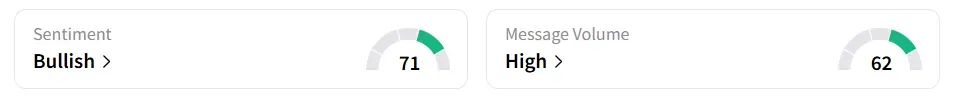

On Stocktwits, retail sentiment toward Couchbase improved to ‘bullish’ from ‘bearish’ the previous day, and the retail chatter jumped to ‘high’ from ‘low’.

Couchbase stock has gained over 59% in 2025 and over 50% in the last 12 months.

Also See: UK Regulator Investigates Amazon Over Supplier Payment Practices, Retail Stays Wary

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)