Advertisement|Remove ads.

Coursera, Boston Beer Draw Massive Surge In Retail Chatter Post Earnings, Fitell Holds Bullish Ground

Retail sentiment on Coursera and Boston Beer shares strengthened following their earnings releases, while Fitell remained in bullish territory, placing all three among the most discussed consumer-focused companies on Stocktwits over the past 24 hours.

Here is a look at how the stocks have seen a user message count increase:

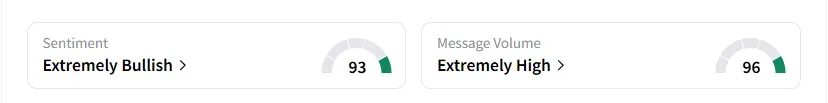

1. Coursera Inc (COUR): The message count on Stocktwits for the global online learning platform jumped 5,500% in the last 24 hours after the company reported its second-quarter earnings on Thursday.

Retail sentiment on the stock improved to ‘extremely bullish’ from ‘bearish’ a day ago, with chatter at ‘extremely high’ levels, according to Stocktwits data.

Shares of Coursera jumped nearly 30% in premarket trading to $11.70 and have gained about 7% year-to-date.

Coursera raised its full-year 2025 revenue outlook to $738 million to $746 million, up from a prior forecast of $720 million to $730 million.

“This quarter, we attracted more than seven million new learners looking to master emerging skills that can advance their careers,” said Coursera CEO Greg Hart.

A bullish user on Stocktwits noted that the key to watch is whether growth in enterprise customers accelerates from here.

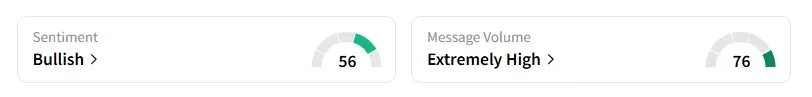

2. Boston Beer Company (SAM): The retail user message volume on the beer company saw a 2,800% surge over the past 24 hours following its quarterly earnings.

Retail sentiment on Boston Beer improved to ‘bullish’ from ‘bearish’ with message volumes at ‘extremely high’ levels, according to data from Stocktwits.

Shares of the company jumped about 14% before the bell after it beat second-quarter profit estimates. Boston Beer reported a profit of $5.45 per share, compared with Wall Street expectations of $3.96, according to data compiled by Fiscal AI.

However, Chairman and Founder Jim Koch said, “Our depletions declined by 5% in the second quarter as volumes were pressured across the beer industry due to economic uncertainty impacting consumer behavior and some impact from poor weather in some key selling weeks.”

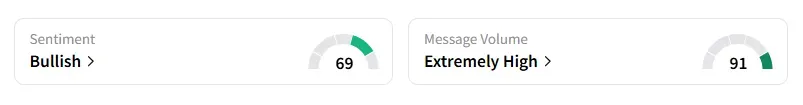

3. Fitell Corp (FTEL): Retail message count on the stock saw a 1,750% increase on Stocktwits in the last 24 hours, with no particular news from the online retailer of gym and fitness equipment.

Retail sentiment on Fitell remained unchanged in the ‘bullish’ territory with chatter levels at ‘extremely high’ levels, according to Stocktwits data.

Shares of the company were down nearly 4% in premarket trading and have lost about 90% of their value so far this year. Fitell is expected to post quarterly results on July 31.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)