Advertisement|Remove ads.

Crocs Stock Climbs As UBS Lifts Price Target To $110, Retail Maintains Bullish Buzz Despite Tariff Clouds

Crocs (CROX) on Monday saw a price target hike from UBS to $110 from $105, with the firm highlighting that it does not expect the footwear maker to provide third-quarter or fiscal 2025 guidance due to tariff-related uncertainty.

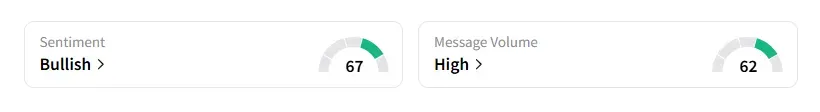

Shares of Crocs were up 1.3% during premarket trading on Monday. Retail sentiment on the stock remained unchanged in the ‘bullish’ territory with ‘high’ levels of chatter, according to Stocktwits data.

UBS maintained a ‘Neutral’ rating on Crocs, according to TheFly. The brokerage noted that Crocs' second-quarter (Q2) fundamental trends were mixed and expects quarterly results to be roughly in line with consensus estimates.

In May, Crocs announced that, due to macroeconomic uncertainties stemming from global trade policies, it was withdrawing its full-year 2025 financial outlook, which was provided in February.

U.S. President Donald Trump’s tariffs on Asian countries, primarily Vietnam and China, have led to many apparel and footwear manufacturers withdrawing their forecasts or deciding not to provide full-year guidance since most of these companies heavily import from Vietnam and China into the U.S.

Crocs' imports or sourcing mix into the U.S. in 2025 consisted of approximately 47% from Vietnam, 17% from Indonesia, 13% each from China and India, and 5% each from Mexico and Cambodia.

The company stated in May that it expects gross margin pressure from tariffs to begin in the second quarter and estimates the largest impact to occur in the second half.

Crocs’ second-quarter net revenue is expected to rise 4% to $1.15 billion, and earnings per share (EPS) is estimated to come in at $4.03, according to data compiled by Fiscal AI.

The company is scheduled to report its quarterly results on June 30, before the opening bell.

Crocs’ shares are down nearly 3% year-to-date and over 19% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Dow Futures Rise After Trump Strikes Trade Deal With EU: TSLA, LNG, LMT, ASML Among Stocks To Watch

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_QR_OG_jpg_08610d948a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1230125578_jpg_85f30da0d4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1233729079_jpg_0ced7540cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)