Advertisement|Remove ads.

Crowdstrike Stock Plunges After Q4 Print As Investors Fret Over Slowing Growth, Weak Earnings Guidance: Retail Mood Flips To 'Bullish'

Crowdstrike Holdings, Inc. (CRWD) shares slumped in Wednesday’s premarket trading after the cybersecurity provider reported a slowdown in quarterly operational metrics and issued mixed guidance.

The Austin, Texas-based company reported adjusted earnings per share (EPS) of $1.03 for the fourth quarter of the fiscal year 2025. The bottom-line result exceeded the year-ago figure of $0.95, beating the Finchat-compiled consensus of $0.86 per share.

Revenue climbed 25% year over year (YoY) to $1.059 billion versus the $1.035-billion consensus estimate. However, the YoY growth decelerated from the third quarter’s 29%.

The top- and bottom-line results also exceeded the company’s guidance that called for adjusted EPS of $0.84-$0.86 and revenue of $1.0287 billion to $1.0354 billion.

Among the key operational metrics, annual recurring revenue (ARR) grew 23% YoY to $4.24 billion as of Jan. 31, 2025, with the net new ARR added during the quarter at $224.3 million. The ARR growth decelerated from 27% in the third quarter, but the net new ARR added improved from $153 million.

The adjusted Subscription gross margin remained steady at 80%

Founder and CEO George Kurtz said, “Delivering $224 million of net new ARR, which brings our ending ARR to $4.24 billion, places us firmly on the flight path to our $10 billion ending ARR goal.”

He noted that Crowdstrike saw strong momentum in its next-generation SIEM, Cloud Security, and Identity Protection businesses, surpassing $1.3 billion in combined ending ARR.

Kurtz also noted that accounts adopting its artificial intelligence (AI)-native Security Operations Center (SOC), Falcon Flex, added over $1 billion of in-quarter deal value.

Looking ahead, the company guided first-quarter adjusted EPS and revenue to be $0.64 to $0.66 and $1.1006 billion to $1.1064 billion, respectively. This compares to the $0.95 and $1.104 billion guidance, respectively.

Crowdstrike expects its fiscal year 2026 adjusted EPS and revenue to be $3.33 to $3.45 and $4.744 billion to $4.806 billion, respectively. While the bottom-line guidance trailed the consensus of $3.85, the revenue guidance aligned with the average analysts’ estimate of $4.778 billion.

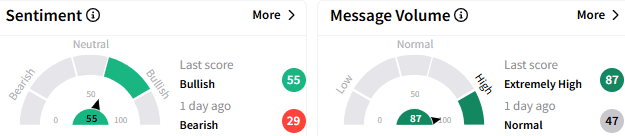

On Stocktwits, retail sentiment toward the stock improved to ‘bullish’ (55/100) from the ‘bearish’ mood that prevailed a day ago. The message volume perked to an ‘extremely high’ level. The stock was among the top 10 trending tickers on the platform.

One bullish watcher shrugged off the soft earnings guidance and noted that this may be a good time to buy more shares.

Crowdstrike stock fell 8.04% to $358.79 in premarket trading, heading toward its lowest level in over a month. However, it is up 14% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)