Advertisement|Remove ads.

We Asked Retail About Their 2025 Outlook On Crude As The Commodity Hit 4-Year Lows: Here’s What They Said

Recessionary concerns have dragged crude oil prices to four-year lows as investors fear a slowdown in economic growth exacerbated by the Trump administration’s tariff plans.

At the time of writing, U.S. West Texas Intermediate (WTI) futures were trading at $59.3 a barrel, down nearly 4.9%, after settling at $62.95 on Wednesday – the lowest level since January 2021.

Currently, WTI crude is down more than 16% since Trump’s ‘Liberation Day’ tariffs took effect on April 2.

However, with the administration announcing a temporary pause of 90 days on reciprocal tariffs, WTI crude futures settled 5.7% higher on Wednesday.

According to Goldman Sachs analysts, WTI crude’s current price is slightly higher than the projected $58 barrel price.

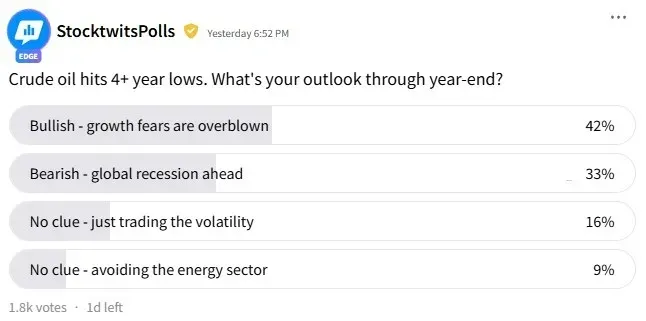

Meanwhile, retail investors on Stocktwits are not as worried about growth prospects. According to an ongoing poll, 43% of the nearly 2,000 respondents believe that growth fears are “overblown.”

A third of the respondents are bearish as they anticipate a global recession ahead.

Sixteen percent of the respondents admitted they have “no clue” and are just trading the volatility, while 8% are avoiding the energy sector altogether.

Amid recession concerns and escalating tariff wars, the SPDR S&P 500 ETF Trust (SPY), which tracks the S&P 500 index, edged lower by over 4% on Thursday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)