Advertisement|Remove ads.

Crypto Miner Bit Digital Stock Pops On Reaching 100K ETH Reserves: Retail’s Exuberant

Cryptocurrency mining firm Bit Digital Inc.(BTBT) announced on Monday that it has pivoted its treasury holdings by shifting from Bitcoin (BTC) to Ethereum (ETH).

After completing its underwritten stock sale, which raised approximately $172 million, Bit Digital implemented its plan to exit Bitcoin exposure and build an Ethereum-centric reserve.

Following the news, Bit Digital stock surged over 20% in Monday morning trade. Meanwhile, Ethereum was trading at around $2,530, representing a 0.7% drop over the last 24 hours.

The firm sold roughly 280 BTC and used the proceeds, along with the offering proceeds, to acquire new ETH.

Heading into the offering, Bit Digital held approximately 24,434 ETH as of March 31, 2025. Following the combined purchases, the company’s Ethereum holdings now total around 100,603 ETH, which amounts to around $254 million based on the cryptocurrency’s current price.

“We believe Ethereum has the ability to rewrite the entire financial system. Ethereum’s programmable nature, growing adoption, and staking yield model represent the future of digital assets,” said Sam Tabar.

“We are starting with exposure to over 100K ETH for now but we intend to aggressively add more so we become the preeminent ETH holding company in the world.”

Bit Digital had announced on June 25 that it is pursuing a focused shift toward becoming an Ethereum-exclusive staking and treasury enterprise.

The company initially began acquiring Ethereum and building out staking infrastructure in 2022 and has gradually expanded its ETH reserves since then.

According to the latest data from CoinShares, Bitcoin’s (BTC) investment inflow was $790 million last week, marking a decline from the prior three-week average of $1.5 billion. The report noted that market momentum was tilting toward Ethereum, which recorded its 11th consecutive week of inflows.

BitDigital’s first-quarter (Q1) revenue decreased 17% year-over-year to $25.1 million, missing the analysts' consensus estimate of $26.38 million, according to Finchat data.

Revenue from digital asset mining comprised 31% of total revenue in Q1. The company held $61.3 million in cash and equivalents as of March 31.

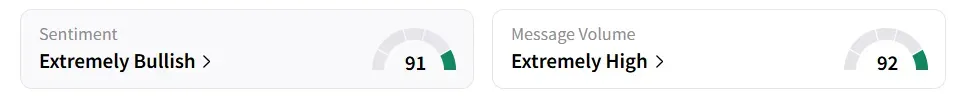

On Stocktwits, retail sentiment around BitDigital remained in ‘extremely bullish’ territory, with extremely high levels of message volume.

A bullish Stocktwits user said the stock is undervalued.

BitDigital stock has gained over 20% year-to-date, but has lost more than 5% in the past 12 months.

Also See: CoreWeave Doubles Down On AI Ambitions With Power-Heavy Core Scientific Merger

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)