Advertisement|Remove ads.

CVS Health Surges Premarket As Q4 Earnings Blow Past Estimates, Retail Buzz Builds

Shares of CVS Health Corp. soared over 9% in Wednesday's premarket trading after the company posted stronger-than-expected quarterly earnings, making it one of the top 10 trending tickers on Stocktwits.

If gains hold, the stock will revisit levels last seen over three months ago.

CVS reported fourth-quarter adjusted earnings per share (EPS) of $1.19, down from $2.12 a year earlier but far exceeding the $0.92 consensus estimate.

Revenue came in at $97.7 billion, beating Wall Street's forecast of $96.88 billion.

"We continue to see growth in key areas like Pharmacy and Consumer Wellness while addressing industry-wide challenges in our Health Care Benefits segment," the company said.

For 2025, CVS guided adjusted EPS between $5.75 and $6.00, roughly in line with analysts' average of $5.86 estimate.

The company also expects $6.5 billion in operating cash flow for the year.

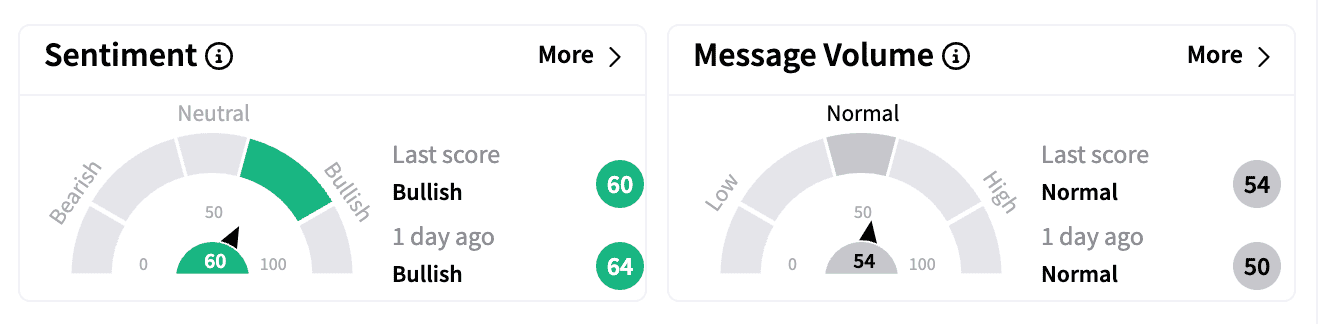

On Stocktwits, ‘bullish’ sentiment prevailed early Tuesday as traders digested the report and hoped for analyst price-target hikes.

One user thought it "was not out of the ballpark" to see the stock hit $65 on Wednesday, while another thought it would reach $80-$90 this year.

According to Bloomberg News, the company's drugstore chain is struggling.

At the same time, it is reportedly working to turn around its Aetna insurance business, which has been hurt by underpriced plans and cuts to quality ratings that impact government payments.

Research firm Edward Jones recently called CVS an "attractive turnaround story," saying new leadership could strengthen Aetna by redesigning plans and cutting costs, with long-term upside for the business model.

CVS stock has dropped nearly 28% over the past year but has rebounded 22% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)