Advertisement|Remove ads.

Cyngn Stock Gains Momentum, Eyes Break Above $0.25: Retail Traders Saw It Coming

Nano-cap Cyngn, Inc.’s (CYN) stock is sharply higher in Tuesday’s premarket trading following its nearly 207% jump in the previous session. The premarket gains point to a potential gap-up open above the $0.25 psychological resistance, as predicted by a majority of Stocktwits users.

Monday’s gain came along with a spike in trading volume to about 91 times above the average level.

On Friday, the autonomous driving software maker disclosed stakes owned by New York-based hedge fund manager Michael Bigger and his funds in a Schedule 13G/A filing — a form used to report any stock ownership that exceeds 5% of the total outstanding shares. These include:

- Bigger Capital Fund LP beneficially owned 17.45 million shares of the company, representing a 4.99% stake.

- Bigger Capital Fund GP LLC owned 17.45 million shares

- District 2 Capital Fund LP owned 11.35 million

- District 2 Capital LP owned 11.35 million

- District 2 GP LLC owned 11.35 million

- District 2 Holdings LLC owned 11.35 million

- Michael Bigger owned 28.79 million

The disclosure came a day after the company said in a separate filing that it received a letter from Nasdaq notifying it that it was not in compliance with the listing standards related to maintaining a minimum bid price of $1 per share.

The company now has 180 calendar days to regain compliance.

Cyngn said it plans to request a stay on the suspension before a Nasdaq panel.

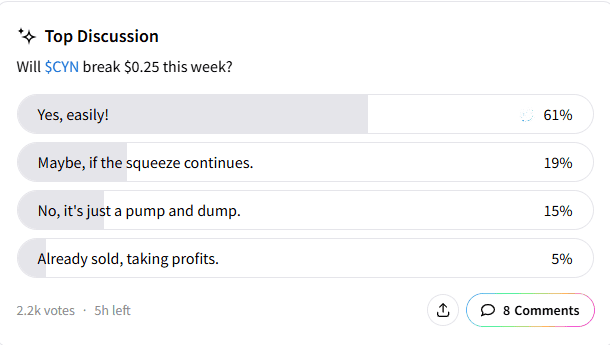

An ongoing Stocktwits poll that collected responses from 2,200 users so far, found that 60% expected the stock to easily break above the $0.25 barrier this week. Another 19% said the stock could break the barrier, if the short squeeze continued.

Only 16% saw it as a “pump-and-dump” move, while 5% said they already took profits on Monday’s rally.

According to Yahoo Finance data, about 5.93% of the outstanding Cyngn shares were held as short.

A Stocktwits platform user said the stock is trending up amid intermittent weakness.

Another user saw the weakness seen in December due to dilution fears and in the first half of January as a thing of the past. They saw the stock easily climbing past the $1 level.

Cyngn stock jumped 34.22% in premarket trading to $0.2479. The stock has lost about 80% this year. The stock is among the top five trending tickers on Stocktwits.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)