Advertisement|Remove ads.

Why Does Dan Ives Believe ORBS Stock Is Becoming An Increasingly Attractive Investment?

- The Pennsylvania-based company, which pivoted from inventory management to cryptocurrencies, is currently developing a universal framework for digital identity and authentication.

- This includes a Worldcoin token treasury strategy through which Eightco plans to build a technology infrastructure layer for authentication, verification, and “proof of humanity.”

- Eightco plans to hold 800 million Worldcoin tokens and eventually onboard eight billion humans to its platform.

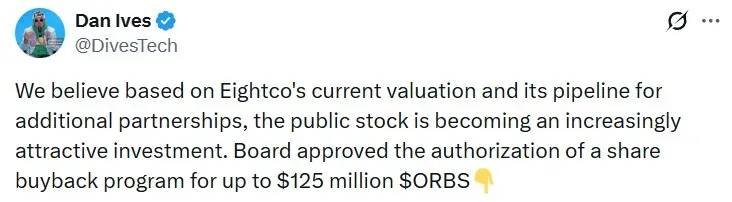

Dan Ives, chairman of Eightco Holdings Inc. (ORBS), on Monday said ORBS stock is becoming an “increasingly attractive investment” after the company’s board of directors approved a share buyback program of up to $125 million.

“We believe based on Eightco's current valuation and its pipeline for additional partnerships, the public stock is becoming an increasingly attractive investment,” Ives said in a post on X.

Eightco shares were up more than 28% in Monday’s opening trade. Retail sentiment on Stocktwits around the company trended in the ‘neutral’ territory at the time of writing.

The company counts BitMine Immersion Technologies Inc. (BMNR), OZAYYX, World Foundation, Wedbush, Coinfund, Kraken, and others as its strategic and institutional investors.

What Does Eightco Do?

The Pennsylvania-based company, which pivoted from inventory management to cryptocurrencies, is currently developing a universal framework for digital identity and authentication.

This includes a Worldcoin (WLD) token treasury strategy through which Eightco plans to build a technology infrastructure layer for authentication, verification, and “proof of humanity.” The “proof of humanity” concept involves the use of an iris-scanning technology.

Eightco plans to hold 800 million Worldcoin tokens and eventually onboard eight billion humans to its platform, in line with its vision of a single sign-on future. The company currently holds 10% of the WLD supply in circulation.

Eightco’s partner, Worldcoin, is backed by OpenAI CEO Sam Altman.

Eightco’s AI Authentication Pilot

As part of its “humanness” authentication vision, Eightco announced a new pilot in October. “With trillions of dollars being invested in AI, the lack of scalable human-proof authentication has become a critical enterprise challenge,” Ives said, while making the announcement.

He added that this new program will help companies analyze single sign-on capabilities and verification pathways in an increasingly digital environment.

Eightco also announced a new “Infinity” program later in October to deliver secure, AI-resistant authentication for platforms in financial services and other industries. The company stated that this technology is designed to defend against deepfakes, Sybil attacks, and other AI-generated threats.

ORBS stock is down 7% year-to-date, but up 27% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)