Advertisement|Remove ads.

Dan Ives Raises His Price Target On Rivian – Why Does He Expect 2026 To Be A Significant Year For The Company?

- Ives maintained an ‘Outperform’ rating on the stock.

- Wedbush sees 2026 as a significant year for Rivian, with the SUV launch expected to boost delivery metrics and the autonomy roadmap, boosting alternative revenue sources.

- On Thursday, Baird upgraded Rivian to ‘Outperform’ from ‘Neutral’ and also increased its target price to $25 per share from $14.

Wedbush Managing Director and Senior Equity Research Analyst Daniel Ives raised Rivian Automotive Inc.’s (RIVN) price target to $25 from $16 with an ‘Outperform’ rating on Friday, citing the company’s expected R2 launch and autonomy roadmap.

Ives noted that they believe 2026 would be a significant year for Rivian given its new SUV launch, which would boost delivery metrics, according to TheFly. Rivian’s new autonomy roadmap would help the automaker tap into alternative revenue sources while also managing costs related to tariffs and business investments, he added.

Recent Street Action

On Thursday, Baird upgraded Rivian to ‘Outperform’ from ‘Neutral’ and also increased its target price to $25 per share from $14.

Last week, Goldman Sachs increased Rivian’s price target to $16 from $13 while maintaining a ‘Neutral’ rating, while Needham maintained a ‘Buy’ rating, raising the price to $23 from $14.

The analyst action comes amid increased confidence in Rivian’s new SUV, the R2 model, expected to launch in 2026. Earlier this month, the car maker also made a series of announcements at its AI and autonomy event, including the development of its custom chip, RAP1 (Rivian Autonomy Processor 1), which would help it achieve level 4 vehicle autonomy, as well as an Autonomy+ subscription for its next-gen customers.

How Did Stocktwits Users React?

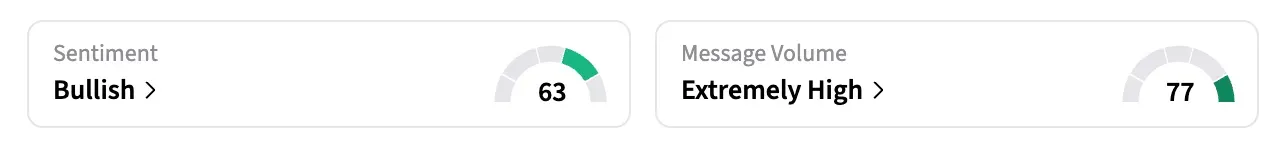

On Stocktwits, RIVN was among the top trending stocks on Friday morning. The retail sentiment around RIVN remained in the ‘bullish’ territory over the past 24 hours, and message volume stayed at ‘extremely high’ levels at the time of writing.

One Stocktwits user highlighted the upgrade and said that they expected the price to rise above $25.

Another user opined that they expect the stock to hit $100 soon.

Shares of RIVN are up over 53% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lemonade_resized_jpg_fe42e63791.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_openai_sam_altman_resized_jpg_70d64e6db7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2261646866_jpg_de6ca7bdf0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/iran_fm_iaea_chief_rafael_mariano_grossi_jpg_79ef4dc11f.webp)