Advertisement|Remove ads.

Dan Ives Says Nvidia-OpenAI Deal Is A ‘Validation Moment’ For The AI Revolution

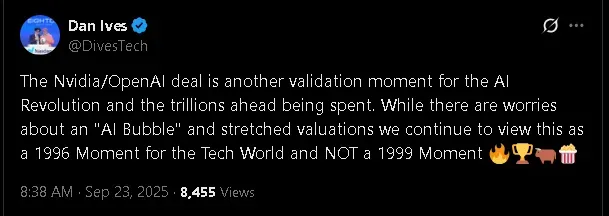

Wedbush analyst Dan Ives on Tuesday called the recently announced Nvidia-OpenAI partnership a “validation moment” for the ongoing AI revolution, likening it to the tech boom of 1996 rather than the overstretched valuations of 1999.

The agreement will see 10 gigawatts (GW) of Nvidia (NVDA) systems deployed for OpenAI’s (OPENAI) next-generation AI models, accompanied by a $10 billion investment from the AI bellwether.

“We continue to view this as a 1996 moment for the tech world, and not a 1999 moment,” Ives wrote in a post on X.

Nvidia’s stock fell as much as 1.7% on Tuesday morning after hitting an intraday high of over $184.50 in the previous session. On Stocktwits, retail sentiment around the tech giant moved higher within ‘bullish’ territory. Meanwhile, retail sentiment around OpenAI, which is not a publicly traded company, was in ‘extremely bullish’ territory with chatter at ‘extremely high’ levels.

Ives’ comments came amid concerns of an ‘AI bubble’ in the making, characterized by excessive hype and company valuations that might not hold up.

Bain & Co. estimates that AI companies like Nvidia and OpenAI will require roughly $2 trillion in combined revenue to fund the computing power needed to meet projected demand for AI services. Current projections, however, suggest they could fall about $800 billion short of that target, according to the company.

“If the current scaling laws hold, AI will increasingly strain supply chains globally,” said David Crawford, chairman of Bain’s global technology practice.

OpenAI CEO Sam Altman and board chair Bret Taylor have also recently hinted that the industry could be in bubble territory.

Read also: XRP Tops Altcoins As Crypto Markets Stabilize After $1.68 Billion Futures Liquidation

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215666275_jpg_07d03239b9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)