Advertisement|Remove ads.

Dave Stock Gains After-Hours On Q4 Profit Beat, Retail Mood Brightens

Dave Inc (DAVE) shares rose 5.2% in extended trading on Monday after the fintech company’s fourth-quarter earnings topped Wall Street’s estimates.

On an adjusted basis, the company reported a net income of $29.6 million, or $2.04 per share, while Wall Street expected the company to post $0.42 per share, according to FinChat data.

Its quarterly net revenue was $100.9 million compared with $73.2 million a year earlier. Wall Street expected the company to report $95.27 million in revenue.

Dave reported a net income of $16.8 million, or $1.16 per share, compared with a profit of $0.2 million, or $0.01 per share, in the year-ago quarter.

The Los Angeles-based company said its new members rose 12% to 766,000 compared to the same period last year.

The company’s monthly transacting members rose 17% to 2.5 million during the fourth quarter.

Dave projected 2025 revenue in the range of $415 million and $435 million. Wall Street expects it to post $408.5 million.

“Given our growth trajectory, strong variable margins and the scalability of our business model, we expect to drive another record year of performance in 2025,” Chief Financial Officer Kyle Beilman said.

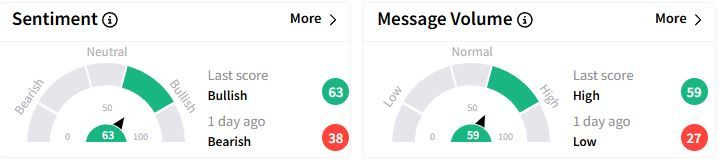

Retail sentiment on Stocktwits flipped to ‘bullish’ (63/100) territory from ‘bearish’(38/100) a day ago, while retail chatter rose to ‘high.’

Over the past year, Dave stock has more than quadrupled.

Last year, the U.S. Justice Department filed a complaint against Dave, alleging that the company misled consumers by falsely advertising its cash advances and adding hidden fees. The government also accused the company of misrepresenting the use of customer tips.

Dave had said that most of the allegations were incorrect and vowed to defend itself.

Also See: New Fortress Energy Stock Rises After-Hours On Q4 Profit Beat, Retail Optimism Grows

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)